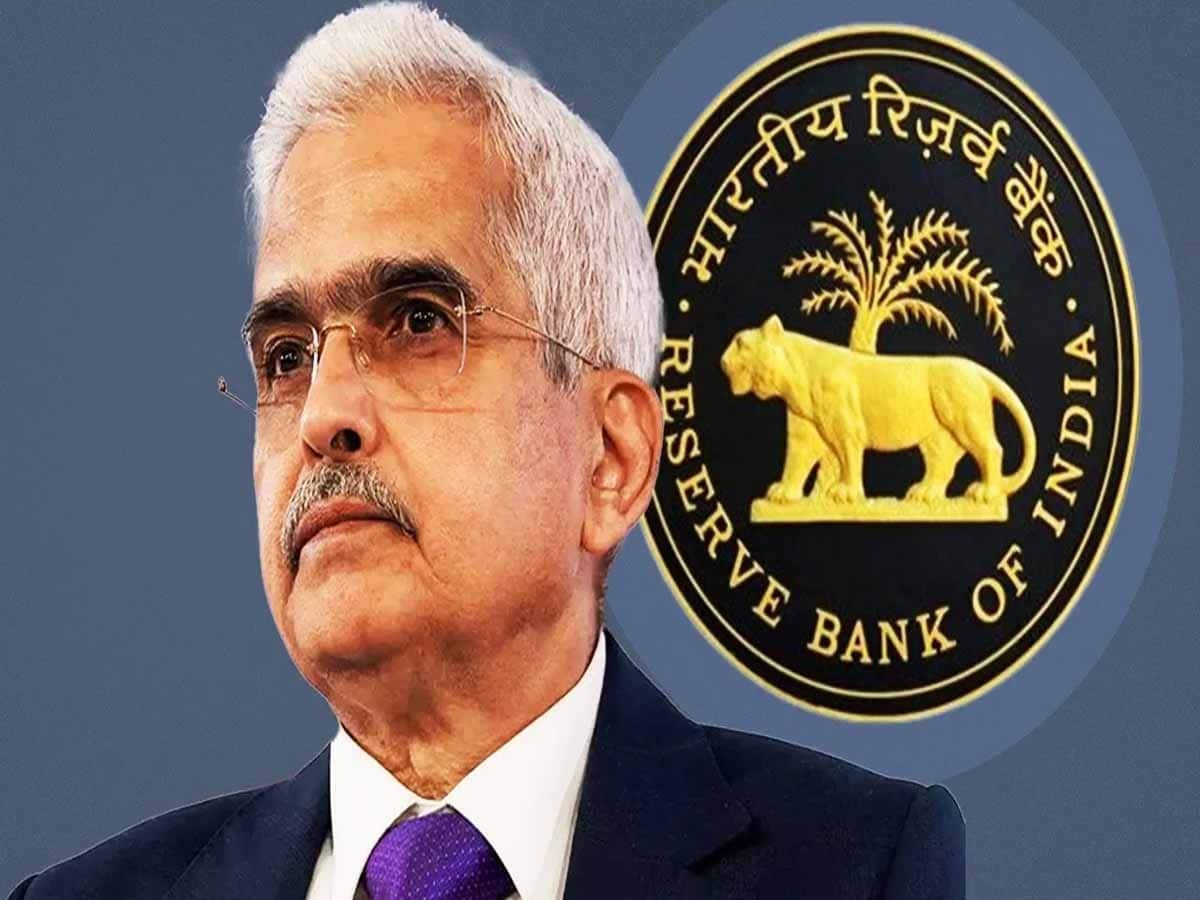

RBI MPC meeting: The results of the three-day bi-monthly Monetary Policy Review (MPC) of the Reserve Bank of India (RBI) will be announced in a few hours from now. Today is the last day of the three-day MPC which started from October 7. RBI Governor Shaktikanta Das will give information about the decisions taken in the meeting. If you are waiting for a cheap home loan or personal loan then today you may get another shock. Looking at the inflation figures, there is no possibility of a cut in the repo rate this time too. However, various industries including real estate have been demanding relief in interest rates for a long time.

No change in MPC repo rate for nine consecutive days

However, if RBI does not change the repo rate this time too, it will be the 10th consecutive time that it will be kept at the old level. RBI last increased the repo rate to 6.5 percent in February 2023. Since then, the repo rate has remained unchanged in the last nine bi-monthly monetary reviews. The government has tasked the central bank to ensure that the retail inflation rate based on the Consumer Price Index (CPI) remains at four percent (up or down two percent). Now experts believe there is little hope that the RBI will not follow the US Federal Reserve, which has cut the benchmark rate by 0.5 per cent.

Inflation estimate may come down by 0.1-0.2 percent and there is no possibility of any change in GDP estimate. The central bank last raised the repo rate to 6.5 percent in February 2023 and it has remained at the same level since then. ICRA Chief Economist Aditi Nair said that in view of GDP growth being lower than MPC's estimate in the first quarter and retail inflation rate being low in the second quarter, it is considered appropriate to keep it at the old level in October 2024 MPC. He said that the repo rate may be reduced by 0.25 percent in December 2024 and February 2025.

Inflation rate still a cause for concern

This time three new external members have been included in the MPC. Retail inflation remains a cause for concern. Apart from this, there is a possibility of further deepening of the crisis in West Asia, which will affect the prices of crude oil and commodities. RBI Governor Shaktikanta Das will give detailed information about the decisions taken by the MPC. Sources believe that there is no hope of reduction in repo rate from the Reserve Bank, because the inflation rate is still at a worrying level. The repo rate remains unchanged at 6.5 percent through February 2023. A recent statement issued by the Finance Ministry said that Ram Singh, Saugata Bhattacharya and Nagesh Kumar have been appointed as the new external members of the MPC.

What is repo rate?

The rate at which RBI gives loans to banks is called repo rate. Increase in repo rate means that banks will get loans from RBI at higher rates. Due to this, interest rates on home loan, car loan and personal loan etc. will increase, which will have a direct impact on your EMI.

look news india

look news india