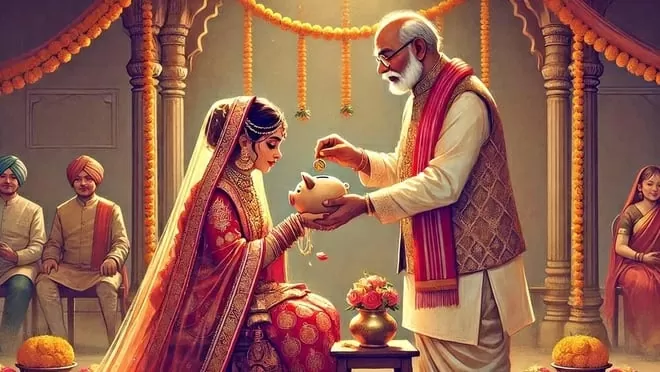

Sukanya Samriddhi Yojana: The Government of India runs many schemes which benefit the citizens of the country. The government has also started Sukanya Samriddhi Yojana under the Beti Bachao Beti Padhao scheme. The aim of this scheme is to secure the future of daughters. They have to be given higher education. Also, funds have to be raised for their marriage.

In this scheme, the parents or legal guardians of the daughter can open an account and deposit a good amount for her future. If you start investing in Sukanya Samriddhi Yojana for your daughter. So you deposit only ₹ 500. Even then you can deposit lakhs of rupees by the time of her marriage. Let us tell you how to invest in this scheme.

Lakhs of rupees will be deposited on investment of 5000 rupees

Under Sukanya Samriddhi Yojana, any parent or guardian can open an account for their two daughters. If two daughters are twins, then accounts can be opened for three daughters. An account can be opened for a daughter below 10 years of age under this scheme. Under this scheme, if you open an account for your daughter and deposit Rs 500 in the account every month, then you can deposit about Rs 3 lakh in 15 years. The current interest rate in this scheme is 8.02%.

If you deposit Rs 500 every month, you will deposit Rs 6000 in a year. That is, in 15 years you will have deposited Rs 90000. At an interest rate of 8.2% on these Rs 90,000, you will get an interest of Rs 1,97,000 in 15 years. If you add the interest amount and your deposit amount, the total comes to Rs 2,87,000. That is, if you open an account for your daughter at the age of 8, then after 15 years, if you marry her at the age of 23, you will have lakhs of rupees.

How to open an account in Sukanya Scheme?

To open an account in Sukanya Yojana, you can go to your nearest post office or bank. Here you will have to take the form related to the scheme. Along with filling the necessary information in it, you will have to submit the daughter's birth certificate, your identity card, address proof and your PAN card, after which you will have to fill the form and submit it to the officer. As soon as the account is opened, information will be sent to your registered mobile number. You can invest a minimum of Rs 250 in the scheme. While a maximum of Rs 1.5 lakh can be invested in a year.

look news india

look news india