New Delhi, 20 November (HS). The decline in the domestic stock market that started on September 30 seemed to be taking a break on Tuesday. However, market experts believe that one day’s strength of the market cannot predict the future’s movement. The way to stop the decline that has been going on in the domestic stock market for more than a month will be clear only when foreign institutional investors start buying instead of selling.

Market experts say that during the quarter ending September, the weak quarterly results of companies listed in the domestic stock market had a very bad impact on the market sentiment. In such a situation, the domestic stock market is now waiting for the results of the quarter ending in December. These results will have a huge impact on the market. If the results of companies are positive in the third quarter, then the stock market can make a strong comeback. Along with this, the policies of the new government after the swearing in of Donald Trump will also affect the buying or selling of foreign investors.

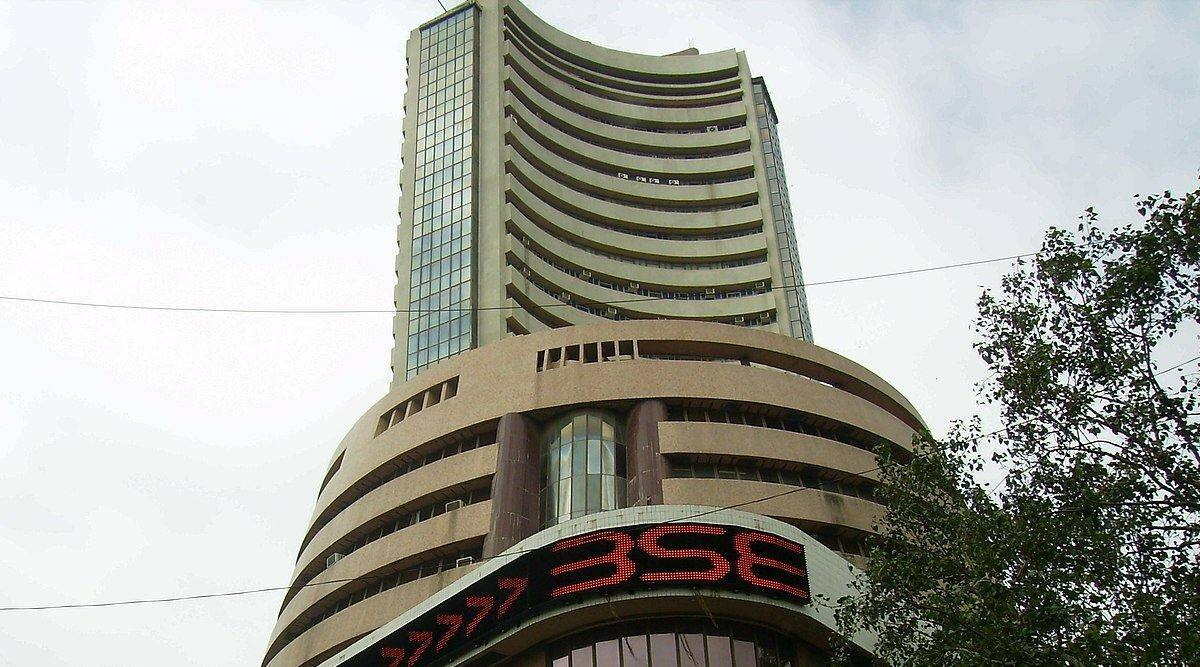

Manish Ahuja, CEO of Ahuja Commodities and Financial Services, says that the domestic stock market seemed to be making a comeback on Tuesday. In the first session of the day itself, both Sensex and Nifty indices had gained more than 1.3 percent, but due to Ukraine’s attack on Russia, foreign investors spoiled the market sentiment by all-round selling in the last hour itself. Although despite this selling, the stock market was successful in closing with normal gains, but due to this an atmosphere of fear was created among the investors.

According to Manish Ahuja, if there is a continuous bullish atmosphere in the market even for a week, then the sentiments can become positive, which can give a trigger to the stock market. Such a trigger should not be expected to persist for a long time. Permanent strengthening of market sentiment will be seen only when foreign institutional investors stop or minimize withdrawal of money from the domestic stock market. Along with this, if foreign investors start investing money in the domestic stock market, then the stock market will once again start running at a gallop.

On the market situation, Manish Ahuja said that in the trading period from September 30 till now, foreign investors have withdrawn Rs 1.20 lakh crore from the equity market by selling. The good thing is that during this period, domestic institutional investors have also made aggressive purchases worth about Rs 1.15 lakh crore. If the results of the companies during the second quarter had not been weak, then such a huge fall in the domestic stock market would not have occurred. Due to weak results of companies, market sentiment continued to deteriorate.

Due to weak results of companies, the stock market fell by about 10 percent despite heavy buying by domestic institutional investors. If the quarterly results of the companies had been positive, then despite the selling by foreign investors, with the support of buying by domestic institutional investors, the stock market might not have been able to create new records of strength, but at least it would have remained close to its highest level. Therefore, if the results of companies are positive in the quarter ending December, then market sentiments may improve. In such a situation, with the support of buying by domestic institutional investors, the Indian stock market can once again return to the path of strength.

Along with this, if there is a change in the policies of the American administration after the swearing in of Donald Trump, then foreign investors can also start investing money in the Indian market instead of withdrawing it from the Indian market. If this happens, the market sentiment will get a further boost, due to which the stock market will once again start writing a new story of strength. Manish Ahuja says that right now small and retail investors should keep distance from the market. The way the pressure environment is prevailing in the market, there may be occasional jumps in it, but such jumps can also cause huge losses to small investors.

look news india

look news india