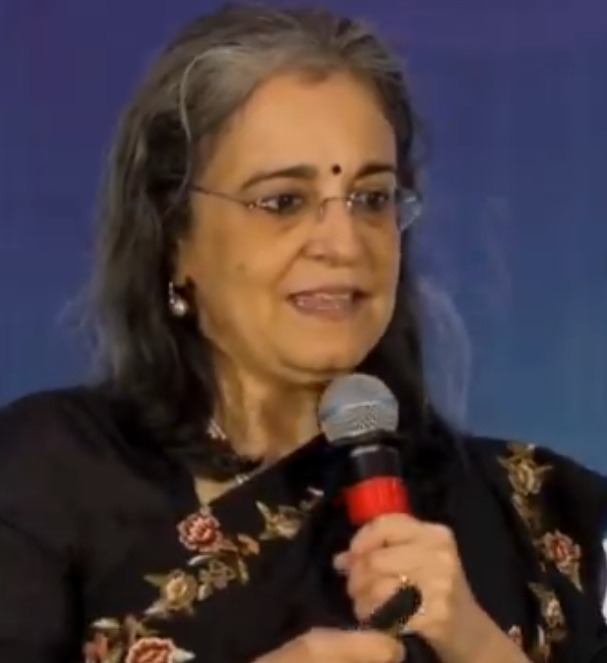

New Delhi, August 11 (HS). Capital market regulator Securities and Exchange Board of India (SEBI) Chairperson Madhabi Puri Buch and her husband Dhawal Buch have issued a detailed statement refuting the allegations made in a recent report by American short-seller Hindenburg Research.

It said that the two had invested in the fund mentioned in the Hindenburg report as a common investor in 2015 while being based in Singapore. This investment was made about 2 years before Madhabi joined SEBI as a full-time member.

The statement further said that the decision to invest in this fund was made because Chief Investment Officer Anil Ahuja is a childhood friend of Dhawal. He has had a strong investment career spanning several decades, being a former employee of Citibank, J.P. Morgan and 3i Group PLC. When Ahuja left his position as CIO of the fund in 2018, we exited the investment in that fund.

At the same time, Anil Ahuja has confirmed that at no time did the fund invest in any bonds, equities or derivatives of any Adani Group company.

Notably, Hindenburg Research in its latest report dated August 10 has alleged that SEBI Chairperson Madhabi Puri Buch had stakes in shadowy offshore entities used in Adani's 'money laundering scam'.

Congress on Sunday demanded a Joint Parliamentary Committee (JPC) probe into the allegations against SEBI.

Congress President Mallikarjun Kharge said that SEBI had earlier given a clean chit to Adani, a close aide of Prime Minister Modi, before the Supreme Court after the revelations of the Hindenburg report of January 2023. However, new allegations have surfaced regarding transactions involving the SEBI chief. Small and medium investors of the middle class invest their hard-earned money in the stock market. They need protection, as they trust SEBI. An investigation by a Joint Parliamentary Committee (JPC) is necessary to investigate this big scam.

look news india

look news india