Mumbai: The Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 6.50 percent at the end of its three-day meeting today. However, the cash reserve ratio (CRR) has been reduced by half to 4 per cent with the aim of supporting the economy by increasing cash flow in the banking system. Despite the decline in economic growth, the Monetary Policy Committee (MPC) of the Reserve Bank has not made any change in the repo rate in the 11th consecutive meeting, keeping in mind the risk of inflation. The Reserve Bank has also reduced the estimate of economic growth rate to 6.60 percent.

The CRR cut will increase cash inflow of about Rs 1.16 lakh crore into the banking system, which will increase liquidity in the economy and help banks control lending rates. As cash flow increases, banks can compete on lending rates to attract borrowers, thereby benefiting borrowers.

The Reserve Bank has sharply reduced the economic growth rate estimate for the current financial year from 7.20 percent to 6.60 percent. The monetary policy stance has been kept neutral which gives the Reserve Bank the option to further cut the repo rate.

At the end of the three-day MPC meeting that began here on December 4, four of the six MPC members voted in favor of keeping the repo rate on hold. Whereas the other two members were in favor of reducing the interest rate by five percent.

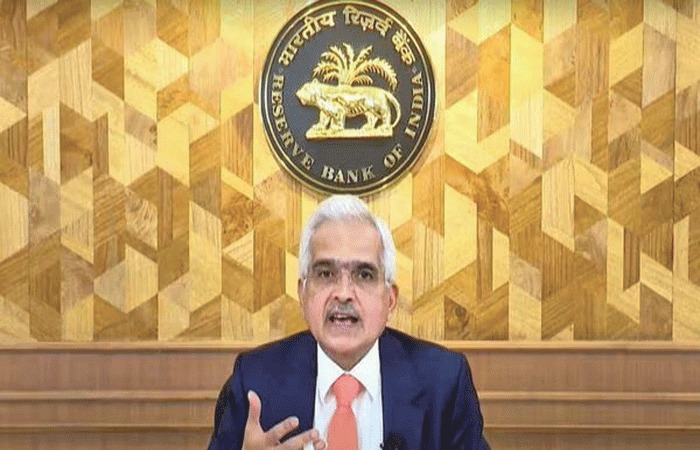

In October of the current year, inflation was higher than expected at a 14-month high of 6.21 per cent, making it appropriate and necessary to keep the repo rate on hold, RBI Governor Shaktikanta Das said in a statement issued after the meeting. Inflation is still well above the target of four percent and we are trying to bring it under control.

The inflation estimate for the entire current financial year has also been increased from 4.50 percent to 4.80 percent.

In view of the country’s economic growth rate being 5.40 percent lower than expected in September of the current financial year and keeping in mind the high inflation rate and pressure on the rupee, the Reserve Bank has no option but to keep the interest rates unchanged. Das said, waiting for inflation to come down.

Food inflation pressure continued in the December quarter also. The Governor expressed hope that this pressure would start reducing from the fourth quarter only after seasonal improvement in vegetable prices and supply of Kharif and Rabi crops.

The percentage of deposits that banks have to keep with the Reserve Bank, i.e. CRR, has been reduced from 4.50 percent to 4.00 percent. This cut will be implemented in two phases on December 14 and December 28.

Das predicted an increase of Rs 1.16 lakh crore in banks’ cash flow due to the CRR cut. Banks with increased cash flow will not have to pay higher rates to receive deposits.

Shaktikanta Das ignored the requests of Finance Minister Nirmala Sitharaman and Commerce Minister Piyush Goyal to reduce borrowing costs. Das’s tenure as Reserve Bank Governor ends on December 10. Asked by a journalist whether he would extend his tenure, Das refused to give a clear answer.

Main points of Reserve Bank’s policy

* MPC kept the repo rate at 6.50 percent in the 11th consecutive meeting.

* Reducing CRR from 4.50 per cent to 4 per cent will increase cash flow of Rs 1.16 lakh crore in the banking system.

* GDP estimate for the current financial year has been reduced from 7.20 percent to 6.60 percent.

* Inflation estimate for the current financial year has been increased from 4.50 percent to 4.80 percent.

* Increase in interest rate limit on FCNR (B) deposits

look news india

look news india