RBI MPC meeting: Skyrocketing inflation has once again put RBI in a dilemma. The Reserve Bank of India (RBI) on Friday, while announcing the bi-monthly review meeting of the Monetary Policy Committee (MPC), kept the repo rate unchanged for the 11th consecutive time. RBI has kept the repo rate stable at 6.5. This move of RBI is a blow to those who were waiting for cheap loans and low EMI for a long time. Now you will have to wait till February to reduce EMI.

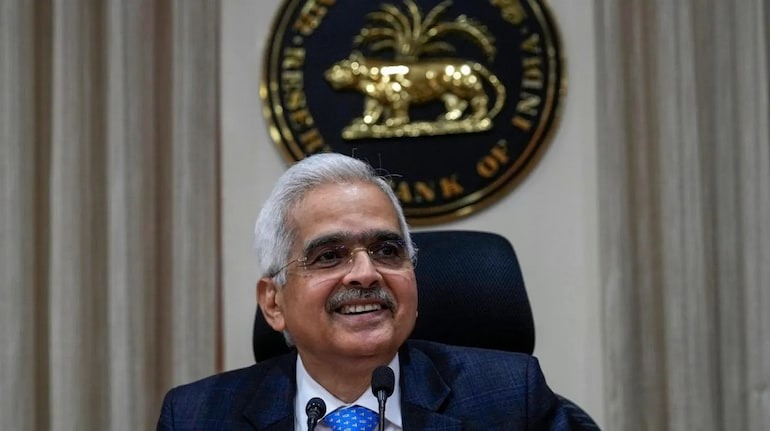

Let us tell you that MPC is the highest decision making body regarding monetary policy headed by Reserve Bank of India Governor Shaktikanta Das. There are a total of six members in this committee including the Governor. The Reserve Bank has kept the repo rate constant at 6.5 percent from February 2023. The government has entrusted the RBI with the responsibility of ensuring that retail inflation remains at four percent with a variation of two percent.

look news india

look news india