When the Reserve Bank of India started increasing the repo rate to control inflation in the country, it reached 6.50 percent. Talking about this time, no change has been made in the last 17 months. At this time, banks have increased interest not only on deposits but also on loans. So now the question is why banks are increasing the burden of common people. RBI has taken special steps on the increase in the prevalence of loans in the country.

There is more demand for loans than deposits in banks

Banks receive money from various sources from the general public. They get a certain interest on this. They lend this money in the form of loans and earn money on interest. But the bank can lend money up to a certain limit of its deposits. They also have to keep some money with them for emergency use. This is called the credit-deposit ratio.

Many banks provide loans in different ways

According to what is being seen now, there is a demand for loans in the market and some banks are giving more loans than their deposits. For this, they also sell assets like government bonds. If we look at the credit-deposit ratio of some banks, HDFC Bank gives 104 percent loan on deposits, Axis Bank gives up to 90 percent loan. Usually it reaches 80 percent.

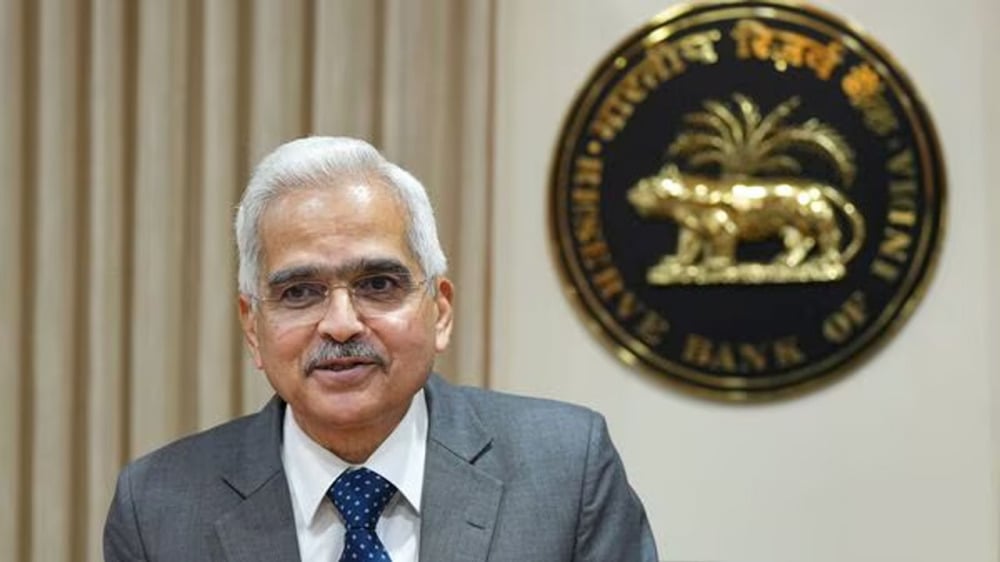

Shaktikanta Das sat

Currently, RBI Governor Shaktikanta Das has held a meeting with the Chief Financial Officers of the major commercial banks of the country. Discussions and concerns have been expressed regarding this issue. Along with this, he also ordered that banks should strictly follow the rules in the audit of finances. Due to all these things, banks are trying to increase deposits.

You will get benefit in depositing money

Many banks of the country have launched new FD or savings schemes. It is giving more interest than normal. People are getting benefit in depositing. For example, SBI has started Amrit Varshi. 7.25 percent interest is being given on 444 days of deposit. In this way, Bank of Baroda is also giving 7.15 percent interest on 666 days of monsoon and 7.25 percent interest on 399 days.

look news india

look news india