RBI Governor on NBFC: In view of the shortcomings and irregularities in the NBFC sector, the RBI Governor has only issued a warning without announcing any major measures. It has called on NBFCs to rectify their mistakes as soon as possible, and threatened to take strict action against the RBI if any wrongdoing is found.

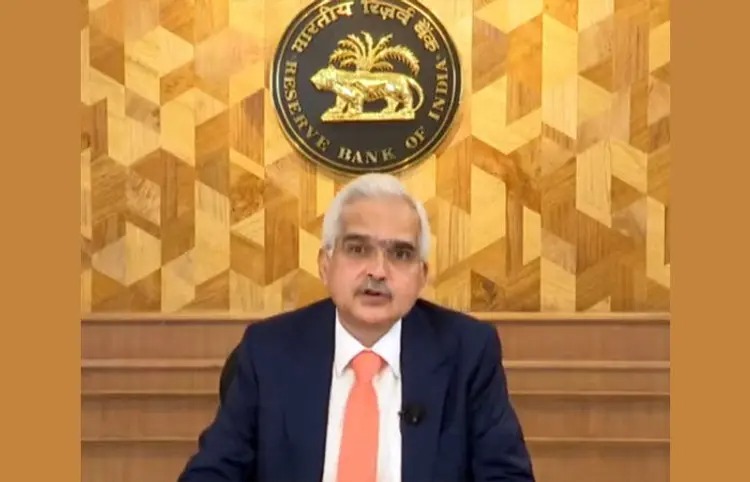

RBI Governor Shaktikanta Das has warned NBFCs that they should rapidly assess, review and self-correct their unsecured loan exposures otherwise strict action will be taken against them. RBI is closely monitoring the regulations and exposures of financial institutions including NBFCs, HFCs. Unsecured loans have seen many challenges. Therefore it is important to be careful.

On Fox Returns of NBFC

Das further said, NBFCs are also focusing on increasing retail targets apart from actual demand. Meanwhile, RBI is monitoring the data released on credit cards, MFI loans and unsecured loans. NBFCs are only focusing on their returns. In which many NBFCs are taking aggressive growth oriented steps without following underwriting practices, which is not appropriate. Against which RBI can take strict action if necessary.

NBFCs, HFCs and micro finance companies are trying to get higher returns on equity. There are some outliers, which RBI is communicating with. Many NBFCs are providing loans at higher interest rates. Which is a matter of concern. In which RBI policies are being violated.

look news india

look news india