RBI Governor has issued a strict warning to the NBFC sector. He says that some NBFCs run more after returns. He said that the NBFC sector should reform itself otherwise they will not hesitate to take strict measures. He also said that now there will be no prepayment charge on floating rate MSME loans. The RBI government said that high costs are a major threat to the stability of NBFCs. Some NBFCs, MFIs, HFCs are chasing higher returns. There will be no hesitation in taking action against NBFCs if necessary.

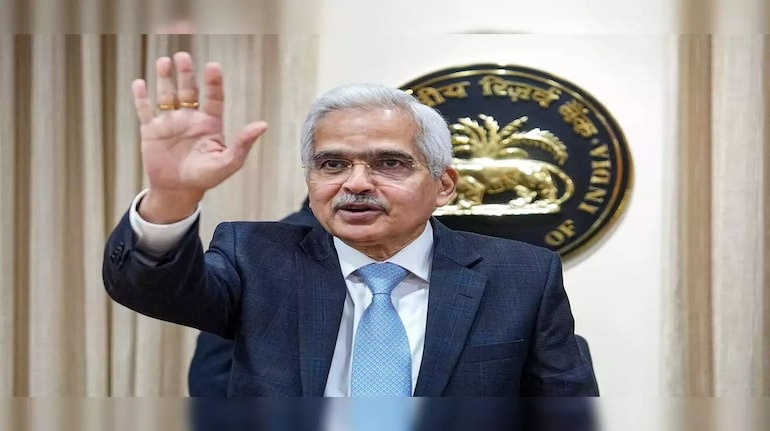

He further said that NBFCs will have to review the existing system. Lenders will have to be strict on regulations and supervision. Recently, challenges have emerged regarding some unsecured loans. Caution should be taken in this regard. Governor Shaktikanta Das said that NBFCs will have to review the existing system. Lenders will have to be strict on regulations and supervision.

Governor Das said that some NBFCs are focusing on increasing retail targets instead of actual demand. In such a situation, RBI is 'closely monitoring' the data on credit cards, MFI loans and unsecured loans. Governor Shaktikanta Das has asked banks and NBFCs to carefully assess their unsecured loan exposure. He also said some lenders are aggressively looking for growth without following strong underwriting practices. This is not a healthy practice.

During his briefing on Monetary Policy Committee decisions on October 9, the Governor said, “Self-treatment by NBFCs would be the preferred option, however RBI is keeping a close eye on this and will not hesitate to take action if necessary. “

Governor Das said some NBFCs, including MFIs and housing finance companies, are looking for 'excessive' returns on equity. Without targeting the NBFC sector as a whole, Shaktikanta Das said there are some 'outliers' with whom the RBI is in talks.

The RBI pointed to this 'push effect' of targets by shadow lenders to spur growth and stressed that 'high leverage' could pose a threat to the strength of NBFCs. RBI said concerns arise when interest rates charged by NBFCs become 'excessive'.

look news india

look news india