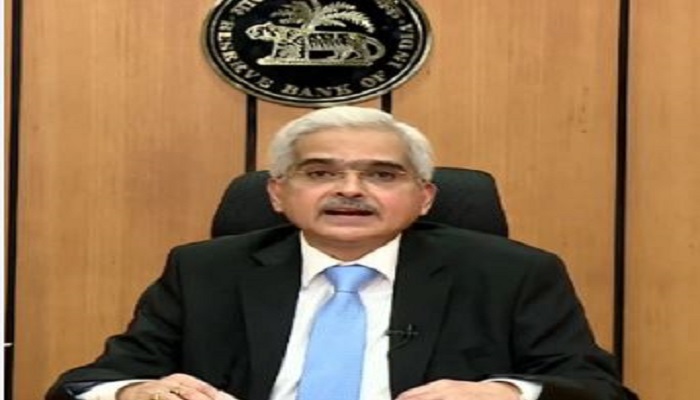

The results of the MPC meeting of the Reserve Bank of India have come out and this time too no change has been made in the repo rate. That is, it has been retained at 6.50 percent. Earlier, in the first MPC meeting of this financial year 2024-25, the policy rates were also kept stable. RBI Governor Shaktikanta Das announced the results of the meeting which started in Mumbai on Wednesday. With the repo rate remaining stable, the EMI of your loan will also remain unchanged. However, the central bank has increased the GDP growth forecast. It has been increased by 20 basis points from 7 percent to 7.20 percent.

RBI kept repo rate unchanged

According to RBI Governor Shaktikanta Das, 4 out of 6 members of the MPC were not in favor of any change in the repo rate. This is the second MPC meeting of the new financial year and at present the repo rate is fixed at 6.50 percent. The Reserve Bank last changed the repo rate in February 2023 and

It was increased by 25 basis points to 6.50 percent. It has not been changed since then.

While announcing the results on Friday, Reserve Bank Governor Shaktikanta Das said that after the discussion in the May MCP meeting, the repo rate has been retained at 6.50%, the reverse repo rate at 3.35%, the standing deposit facility rate at 6.25%. The marginal position facility rate has been kept at 6.75% and the bank rate at 6.75%. It is worth noting that this was the first meeting of the RBI Monetary Policy Committee after the results of the Lok Sabha elections.

RBI kept repo rate unchanged

Let us tell you that the retail inflation rate data for the month of May will be released at the end of this month. According to SBI Research, inflation is expected to remain below 5 percent from October to the end of FY 2024-25. Earlier, wholesale inflation rose to 1.26% in April, which is the highest level in 13 months. Apart from this, retail inflation stood at 4.83 percent in April.

look news india

look news india