NPS Retirement Pension: Retirement planning is an important part of financial decision-making. As time goes by, inflation also rises, and the policy of relying solely on savings after retirement may have to be revised.

To achieve financial independence in post-retirement life, you must invest in a retirement plan that can give you regular income once you reach retirement age. The National Pension Scheme (NPS) is one of the most effective tools in the country to meet that need. NPS is so because it gives you a lump sum amount at retirement age and regular monthly income thereafter.

Since NPS offers compounding returns, a longer investment period will increase your income faster.

For example, if one starts investing at the age of 20, he will have more time to invest, and hence, even small investments can help him build a large corpus at the time of retirement.

NPS: How to get Rs 40,000 pension per month?

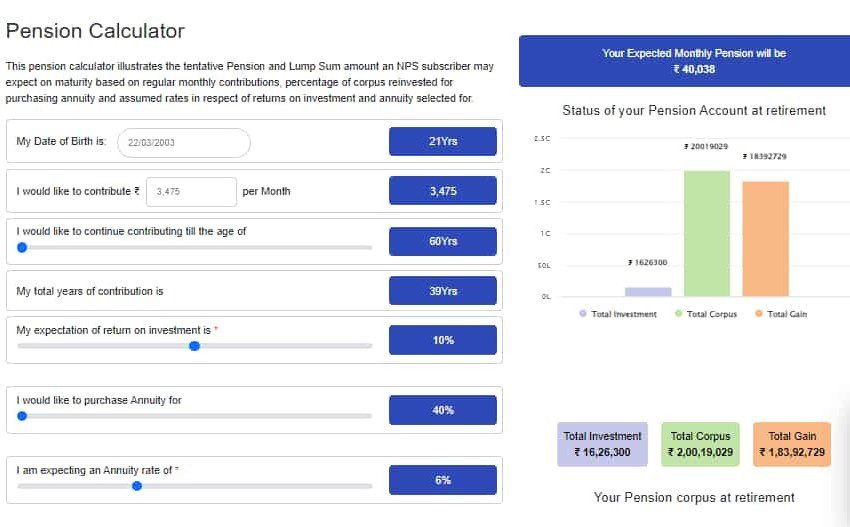

If you start investing Rs 3,475 per month in NPS at the age of 21 and remain invested for the next 39 years, you will earn a pension of Rs 40,000 per month by the retirement age of 60.

NPS: The calculation is as follows:

Age: 21 years

Retirement age: 60

Contribution: Rs 3,475/month

Expected Return: 10%

The person will eventually have a total sum of Rs 2,00,19,029.

If you withdraw 60 per cent of that amount as a lump sum (60 per cent is the maximum limit you can withdraw at retirement age), you will be left with an annuity of 40 per cent.

The government invests the annuity in debt funds or corporate bonds, where the amount invested gives a fixed income. If you get a six percent return on the annuity, then-

The amount invested in annuity would be Rs 80,07,612.

look news india

look news india