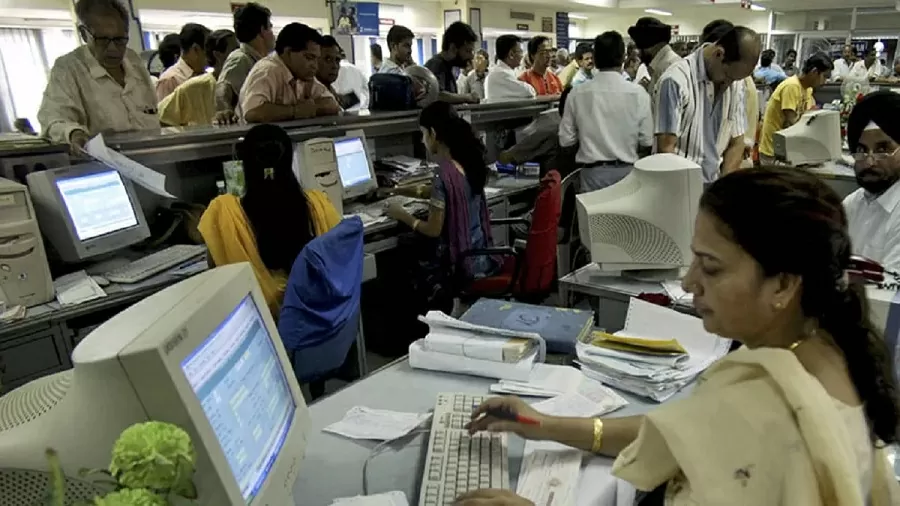

Dormant Bank Account: State Bank of India (SBI) has launched a nationwide campaign to raise awareness about the importance of activating dormant accounts. A savings or current account is considered dormant when the customer has not made any transactions in the account for more than two years. According to the Reserve Bank of India, you will not have to pay any fee to activate any inactive account. If your account has also become inactive, then let us know how to activate the inactive account.

How to activate SBI account?

The customer must first visit any branch of State Bank of India with his latest KYC documents. There you have to place a request to activate the account at the branch. Your account will be activated after the branch verifies your KYC documents. Customers will be informed by the bank about account activation through SMS or email. Please note that any account activation request from the Bank is processed within 3 working days.

How to activate HDFC bank account?

If you are an HDFC Bank customer, you will have to visit the bank branch to activate your account. There you will have to give a written application, on which you will also have to sign. You will also have to provide self-attested proof of identity and address. After this, as soon as you make any transaction in your account, it will be activated again.

IDFC First Bank customers can activate it like this

You have to visit the bank branch to activate your IDFC FIRST bank account. There you will have to fill an application form to activate the account. If your account is a joint account, signatures of all account holders will be required. Along with this, you will have to submit your address proof, PAN card and documents related to identity proof as KYC. After this you will have to make at least one financial transaction, after which the account will be reactivated.

Inactive accounts of PNB will be activated like this

According to the website of Punjab National Bank, to activate the account you will have to visit the bank branch. There you will have to submit a request to activate your account. Along with this, you will also have to provide KYC documents. At the time of activating the account, the customer will have to deposit at least Rs 100 in the account. Aadhar card information will also be taken from the customer for KYC.

look news india

look news india