HRA Rebate Calculation: One of the many such declarations related to savings is made by those who live in a rented house, and who are given HRA i.e. House Rent Allowance as a part of their salary. This HRA i.e. House Rent Allowance can actually help the salaried people living in a rented house and dreaming of their own house to save a lot of income tax, so it is very important that its declaration is done at the right time and in the right way. But the problem is that many salaried people do not know how to calculate the HRA rebate, and also do not know how to get it, so today we have written this news to help you.

Who will get HRA exemption and how…?

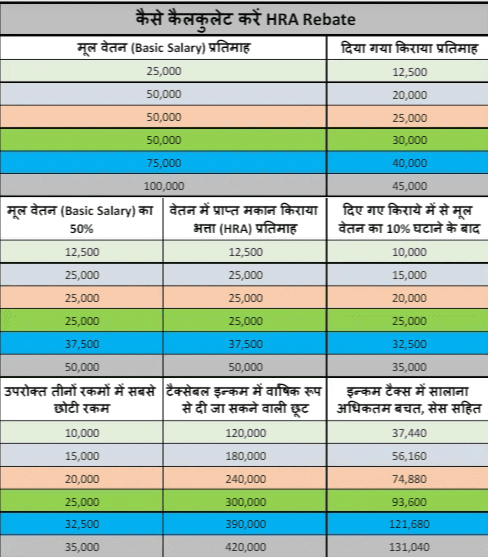

To get HRA rebate, one must first understand who can get HRA exemption in income tax. So remember, there are two most important things for this – firstly, you are given an amount as HRA (House Rent Allowance) as a part of your salary and secondly, the house for which you are claiming rent should not be in your name. Under Section 10 (13A) of the Income Tax Act, any salaried person is allowed income tax exemption on the smallest of the three amounts – 50 per cent of his basic salary, the amount received as HRA or the amount of rent actually paid by him after deducting 10 per cent of the basic salary.

Who can avail how much HRA rebate?

To understand this in detail, we have created this chart. This PDF chart gives an example of six salaried people who get basic salaries of ₹25,000, ₹50,000, ₹50,000, ₹75,000 and ₹1,00,000 per month respectively. These people are also given 50 percent of their basic salary as HRA, and they pay ₹12,500, ₹20,000, ₹25,000, ₹30,000, ₹40,000 and ₹45,000 per month as rent respectively.

Now understand – the first person whose basic salary is ₹25,000, gets ₹12,500 as HRA, and the same ₹12,500 he pays as rent to the landlord every month, so 50 percent of this person's basic salary is ₹12,500, he gets ₹12,500 as HRA, and after deducting 10 percent of the basic salary from the actual rent paid by him, the amount comes out to be ₹10,000. Now since the smallest of these three amounts is ₹10,000, so as per the rule, this person will get HRA exemption on the amount of ₹10,000 per month or ₹1,20,000 per year, i.e. ₹1,20,000 will be deducted from the taxable income of this person, and the maximum amount he will be able to save on this amount is ₹37,400 (in case the person is paying tax in 30 percent slab, and this amount also includes 4 percent cess).

Similarly, the second person in the chart gets ₹50,000 as basic salary, and he gets ₹25,000 as HRA. This person pays ₹20,000 as rent every month. So, 50% of this person's basic salary, i.e. ₹25,000, is deducted from the ₹25,000 received as HRA and half of the basic salary is deducted from the rent paid and this amount appears to be ₹15,000. Now for this person, the smallest of these three amounts is ₹15,000, so he will get HRA exemption of ₹15,000 every month or ₹1,80,000 annually. This way, this person will be able to save a maximum of ₹56,160 including income tax and cess.

In the third and fourth examples, the individuals get only ₹50,000 as basic salary and ₹25,000 as HRA, but they pay ₹25,000 and ₹30,000 per month respectively as rent. Now the basic salary and 50 percent of HRA received by both will remain ₹25,000, but after deducting 10 percent of basic salary from the rent paid, the amount received will be ₹20,000 and ₹25,000 respectively. On this basis, their annual HRA exemption will also be ₹2,40,000 and ₹3,00,000 respectively, on which they will be able to save a maximum of ₹74,880 and ₹93,600 respectively in annual income tax.

The fifth person in the chart got ₹75,000 as basic salary and gets ₹37,500 as HRA. The same person pays ₹40,000 as rent every month. Now this person's basic salary is half of ₹37,500, he gets ₹37,500 HRA and after deducting 10% of basic salary from the rent amount, he gets ₹32,500. So, he can get ₹32,500 per month or ₹3,90,000 per year as HRA exemption, based on which he can save a maximum of ₹1,21,680 in income tax.

The last example is of a person whose basic salary is ₹1,00,000 per month, he gets ₹50,000 as HRA, and he pays ₹45,000 as house rent. Now this person will have three amounts – ₹50,000, ₹50,000 and ₹35,000. So, by taking HRA rebate on the smallest of these three amounts i.e. ₹35,000 per month or ₹4,20,000 annually, he can save a maximum of ₹1,31,040 in income tax.

Important things to remember…

By the way, those who want to get HRA rebate should remember one more thing. If you are paying house rent of more than ₹ 1,00,000 per annum (i.e. ₹ 8,333 per month), then you must also compulsorily enter the PAN number of your landlord (even if it is your parents or wife), and the landlord will have to pay income tax on this rental income. And yes, don't forget – to get HRA rebate, you must also have house rent receipts, which you will have to submit in the office.

look news india

look news india