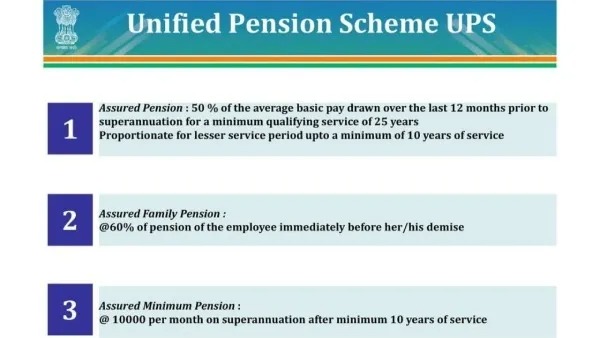

Unified Pension Scheme (UPS): The central government has announced a new pension scheme UPS (Unified Pension Scheme). Under this scheme, employees who have completed 25 years of service will be given an average pension of 50% of the basic salary of the last 12 salaries.

The UPS, approved by the Union Cabinet, is similar to the Old Pension Scheme (OPS) and will be effective from April 1, 2025. UPS employees will contribute 10% of their salary, while the government will add 18.5%. Those who joined the service after 2004 can also switch from the National Pension System (NPS) to UPS.

It is worth noting that 21 years ago, the Atal Bihari Vajpayee government had started the New Pension Scheme. But now the Modi government has retaliated and announced to bring OPS.

Earlier employees used to get the option to choose between Old Pension Scheme and New Pension Scheme, similarly now employees will get the option to choose between New Pension Scheme and UPS.

The biggest advantage of UPS is that the employees will get a hike in salary due to inflation. On the other hand, in case of the death of the employee, the family will get immediate guarantee of 60 percent security. They will also get gratuity and lump sum pension.

UPS(Unified Pension Scheme)

The pension will be 50 percent of the basic salary of the last 12 months.

It is necessary to complete 25 years of service.

If 25 years have not been completed then pension will be given accordingly.

On the death of the employee, the family will immediately get 60 percent pension.

If you have completed 10 years of service, you will get a pension of Rs 10,000.

Employee's contribution is 10%.

Government's contribution is 18.5%.

NPS(National Pension Scheme)

Employees can contribute as much as they want with benefits based on market performance

Employees contribute 10% of the basic salary and DA.

The government is contributing 14 percent.

Any employee can open an account in NPS with a minimum of Rs 500.

Tier 1 is a mandatory account, which offers tax benefits after retirement.

Tier 2 is an optional account from which the employee can withdraw money as per his wish but it does not offer any tax benefits.

Old Pension Scheme

Monthly pension is given on the basis of last salary.

Employees do not have to contribute to the pension.

The pension is 50 per cent of the last salary.

Only the pension of employees who joined service before 1 January 2004 is fully borne by the Central Government.

Due to changes in dearness allowance, the pension keeps changing from time to time.

There is no tax on pension.

Which pension plan has more benefits?

If we compare all three plans, all three come with different advantages and disadvantages. In such a situation, it depends on the employee in which year he joined the service and when he is going to retire.

The advantage of the old pension scheme is that the employee does not have to make any contribution to the pension, the entire expense is borne by the central government itself, which reduces the burden on the government. Although this is a very expensive scheme from the government's point of view, it is very beneficial for the employees.

look news india

look news india