[ad_1]

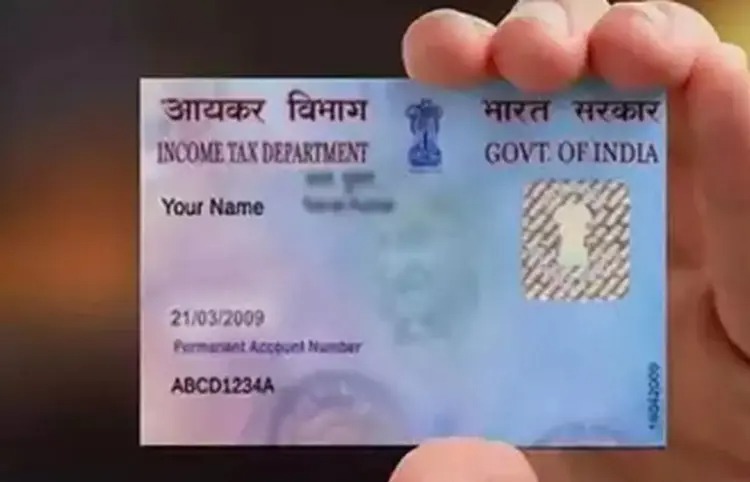

PAN Card Deactivated: Permanent Account Number also known as PAN Card is known as the financial status of an individual. PAN card is required and used for other financial activities including banking, income tax return, but if the PAN card becomes inactive then you may have to face problems.

Inactive PAN card can make it difficult for you to perform banking transactions, filing income tax returns and many other financial tasks. Your PAN card may become inactive or blocked due to many reasons. So let us know how to know that PAN card has been deactivated and how to reactivate PAN card?

Due to PAN card being inactive

1. Not linking PAN-Aadhaar card

2. Having more than one PAN card

3. Fake PAN card

Identify Inactive PAN Card at Home

1. Go to the Income Tax Department website.

2. There will be a Verify PAN Status option in the Quick Links section on the left.

3. After clicking on it, a new page will open.

4. Enter PAN number, full name, date of birth and registered phone number here.

5. Click Continue, then enter the OTP received on the phone number.

6. After this click on ‘Validate’ and then you can see whether your PAN card is active or inactive.

Let us tell you that, when the PAN card is activated, you will see ‘PAN is active and details are as per PAN’ on the screen. Will be seen. If the PAN card is deactivated, you will see the message displayed on the screen saying ‘Inactive’.

How to activate inactive PAN card?

Applying to Income Tax Department to activate inactive PAN card. Write a letter to the Assessing Officer, fill indemnity bond in favor of Income Tax Department, also submit ITR filed using inactive PAN for last 3 years, submit the documents at the Regional Income Tax Office. It will take about 15 days to reactivate the PAN card.

look news india

look news india