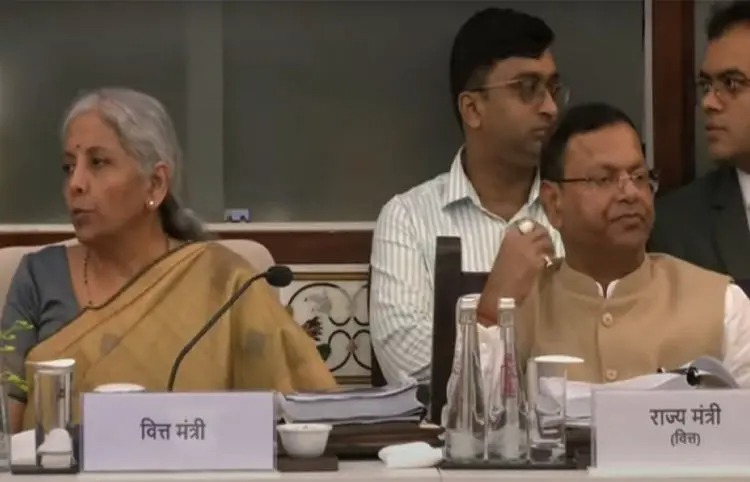

GST Council Meeting: The 54th meeting of the GST Council has begun. The main focus is on the GST on health and life insurance. In this meeting, the decision on this issue has been postponed to the next meeting, because a broad consensus will be needed to remove GST on life and health insurance premiums. Apart from this, the decision to impose 18% GST on sub-contracts on oil and gas exploration has also been postponed. GST waived on research and grants.

Another important focus is digital transactions of Rs. 2 thousand. In which Rs. 2 thousand were done through debit and credit cards. Uttarakhand Finance Minister Premchand Aggarwal said that payment aggregators like BillDesk and CCAvenue have planned to levy 18 percent GST on online transactions up to Rs 2000, but no decision has been taken yet.

GST to be reduced for helicopter pilgrims

Apart from this, the GST Council has accepted the demand to reduce GST on helicopter travel. The GST rate for pilgrims will be reduced from 18 percent to 5 percent. In this meeting with the Finance Minister, the Finance Ministers and tax officials of the states are discussing many important issues including taxation on insurance premium, rationalization of taxes and tax on income from online gaming, tax on online transactions.

No respite for online gaming industry

The online gaming industry has also not got any relief. In the GST Council meeting, 28 percent GST has been retained on online gaming, casinos and race courses. The online gaming industry had been demanding a reduction in GST for a long time, but today's decision has disappointed them. The government levies 28 percent GST on deposits and 18 percent GST on earnings in the above segment.

look news india

look news india