New Delhi, September 14 (HS). The Directorate General of GST Intelligence (DGGI) on Saturday released its Annual Report 2023-24: GST Evasion Trends. The report comprehensively analyzes the pattern of evasion. Along with this, important cases of GST evasion and strategic enforcement have been highlighted.

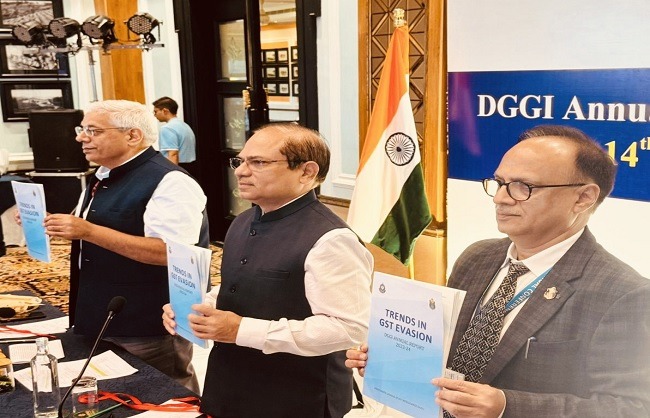

The Central Board of Indirect Taxes and Customs (CBIC) on Saturday reported in an 'Axe' post that the Directorate General of GST Intelligence (DGGI) has released its Annual Report 2023-24: Trends in GST Evasion. The report was released by CBIC Chairman Sanjay Kumar Agarwal in the presence of DGGI Member Compliance Management Rajiv Talwar and others.

The two-day annual conference of Directorate General of GST Intelligence began in Siliguri today. It was inaugurated by Chairman Sanjay Kumar Agarwal. The two-day conference will discuss tax enforcement, identification of emerging tax evasion areas and use of technology to combat financial frauds. The conference will have sessions by eminent invitees from CESTAT, DGARM, Enforcement Directorate, NFSU, I4C, DoT and GSTN covering topics such as advanced digital forensics, NCRP, BIFA and successful investigations.

It is worth mentioning that the Directorate General of Goods and Services Tax Intelligence (DGGI) is a law enforcement agency under the Ministry of Finance. This agency is responsible for fighting tax evasion in India. It was established in 1979 as the Directorate General of Anti-Tax Evasion, which was later renamed as Directorate General of Central Excise Intelligence.

look news india

look news india