CIBIL Score vs CIBIL Rank: Whenever we apply for a loan for an individual or a business firm, terms like CIBIL score and CIBIL rank come up. These terms become essential as it determines whether the loan will be granted or not and if yes, what will be the interest rate. In such a situation, let us understand the 4 main differences between CIBIL score and CIBIL rank.

CIBIL score tells the credit health of a person. For this, the credit history of the person is seen. There is also CIBIL rank credit report (CCR). This is applicable on the terms and conditions of the company.

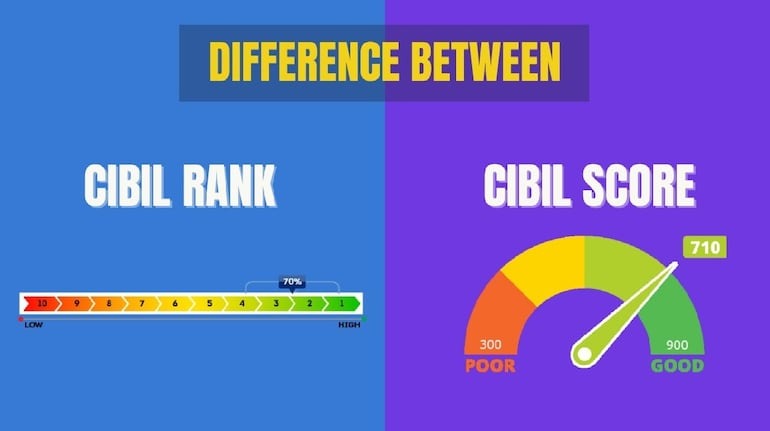

CIBIL Score vs CIBIL Rank: What is the scale?

CIBIL score is applicable for individual customers while CIBIL rank is for companies. CIBIL score is basically a three-digit number ranging between 300 to 900. The higher it is, the better. CIBIL rank is given on a scale of 10 to 1, where 1 is the top rank.

CIBIL Score vs CIBIL Rank: Who is Eligible?

CIBIL score is issued to an individual based on his/her credit history. While CIBIL rank is available for companies with credit exposure up to Rs 50 crore.

CIBIL Score vs CIBIL Rank: How is it calculated?

The CIBIL score is determined by the individual's credit history, report and rating. The main parameters for calculating the CIBIL rank are past payments and credit usage.

look news india

look news india