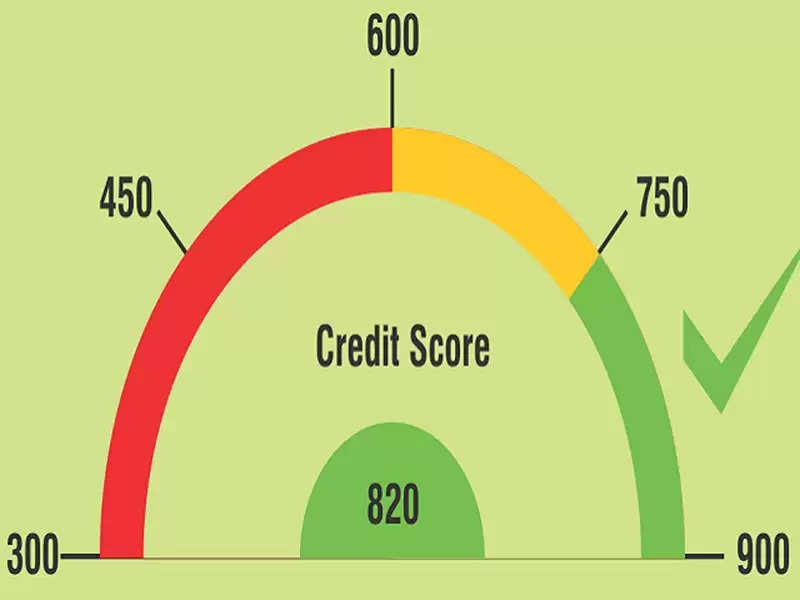

CIBIL score matters a lot in case of loan. If your CIBIL score is good then you get loan easily. On the other hand, if your credit score is bad then there is a problem in getting a loan because banks consider CIBIL score as a measure of credibility. If your CIBIL score is bad and due to this you are not able to get a loan, then there is no need to worry. Here know the ways through which you can arrange money for yourself in difficult times.

Non-profit organizations

If your CIBIL score is bad (low CIBIL score), you are not able to get a loan from the bank and you need money very badly, then you can apply for NBFC. Here you can get a loan even with a low CIBIL score. But the interest rates can be higher than the bank.

Joint Loan

If your income is good enough, then if your CIBIL score is low, you can also opt for a joint loan or make someone your guarantor. If your joint loan holder or guarantor has a good CIBIL score, then you can easily take a loan. Another advantage of this is that if your co-applicant is a woman, then you can also get some benefit in interest rates.

Gold Loan

If you have gold, you can also take a loan against it. Gold loan is kept in the category of secured loan. You can get a loan up to 75 percent of the current value of gold. There is no much paperwork in this and neither is your CIBIL score looked at. This loan is given by mortgaging your loan.

If you have made an FD, or invested in schemes like LIC or PPF, then you can also take a loan on them. In this, you are given a loan based on your deposit amount. A fixed time is given to repay this loan. If your PPF account is at least one financial year old, then you can apply for a loan. Loan facility can be availed on this for 5 years, after which partial withdrawal facility is available.

advance salary loan

Some companies providing financial services offer loans in the form of salary advance. This loan can be up to three times your salary. Another advantage of advance salary loan is that you do not need much paperwork. Advance salary loan is also like a personal loan. You get it easily and you can repay it at fixed intervals through EMI. Usually it has to be repaid within 15 years.

look news india

look news india