In its probe covering the period from January 2006 to March 2008, SEBI found that Mallya used FII Matterhorn Ventures to secretly trade shares of his group companies – Herbertson Limited and United Spirits Limited (USL) – by routing funds through various offshore accounts.

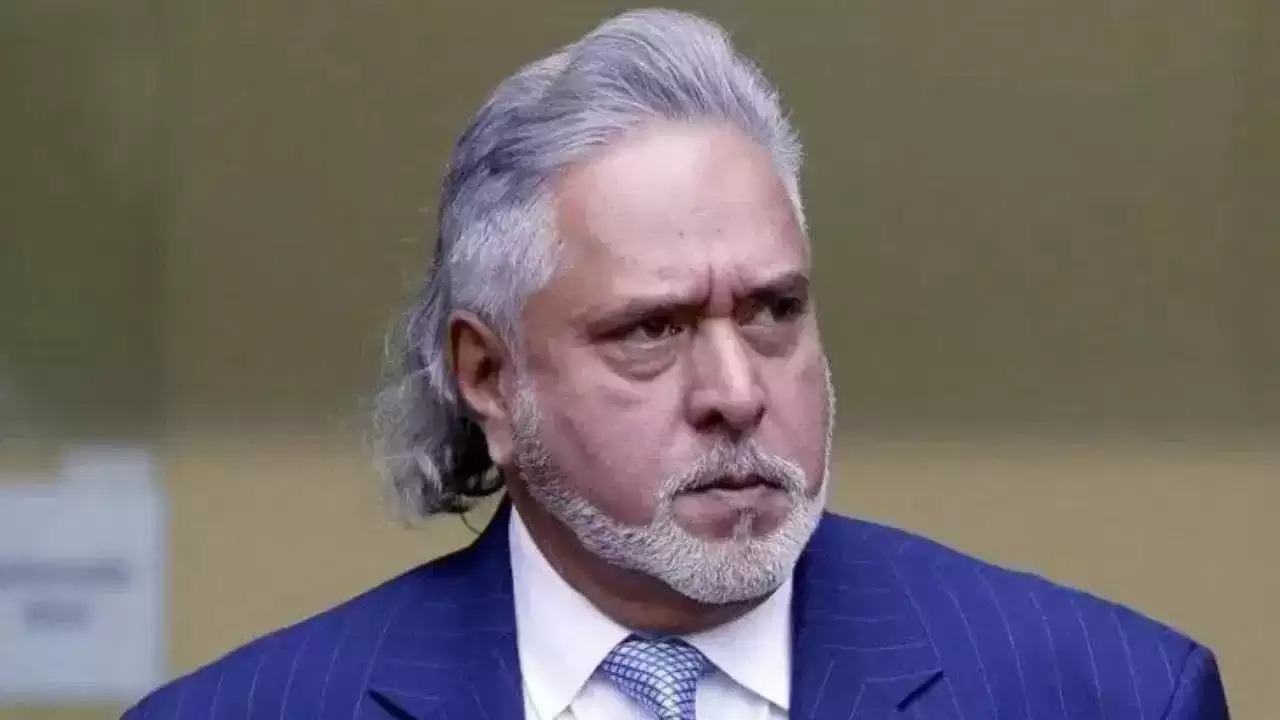

SEBI has taken major action against Vijay Mallya and has banned him.

The government has taken major action against fugitive businessman Vijay Mallya. This action has been taken by the stock market regulator SEBI. Along with banning fugitive businessman Vijay Mallya from the security market, SEBI has also banned him from associating with any listed company for three years. SEBI has taken this action in the case of sending money to the Indian security market using foreign bank accounts with UBS AG. The Indian government is trying to extradite Mallya from Britain to face charges of fraud related to his defunct company Kingfisher Airlines. Mallya has been living in Britain since March 2016.

was sending money like this

The Securities and Exchange Board of India (SEBI) in its investigation of the period January 2006 to March 2008 found that Mallya used foreign institutional investor (FII) Matterhorn Ventures to secretly trade shares of his group companies – Herbertson Limited and United Spirits Limited (USL). For this, funds were sent through various foreign accounts. Former liquor baron Mallya used Matterhorn Ventures to invest money in the Indian securities market through various accounts with UBS AG. He used various foreign entities to hide his real identity.

SEBI's 37 page order

The Sebi order said Matterhorn Ventures was wrongly listed as a non-promoter public shareholder in Herbertson while its 9.98 per cent shareholding was in the promoter category. Sebi Chief General Manager Anita Anup said in her 37-page order that the noticee in this case (Mallya) used his foreign related companies through the FII route to trade in the Indian securities market while concealing his identity and disregarding regulatory norms.

In this way, he planned to indirectly trade in the shares of his own group companies through multi-layered transactions. He said that this act of Mallya is not only fraudulent and deceptive, but also a threat to the integrity of the securities market. In such a situation, SEBI has banned Mallya from entering the securities market. He has been barred from joining any listed firm for three years.

look news india

look news india