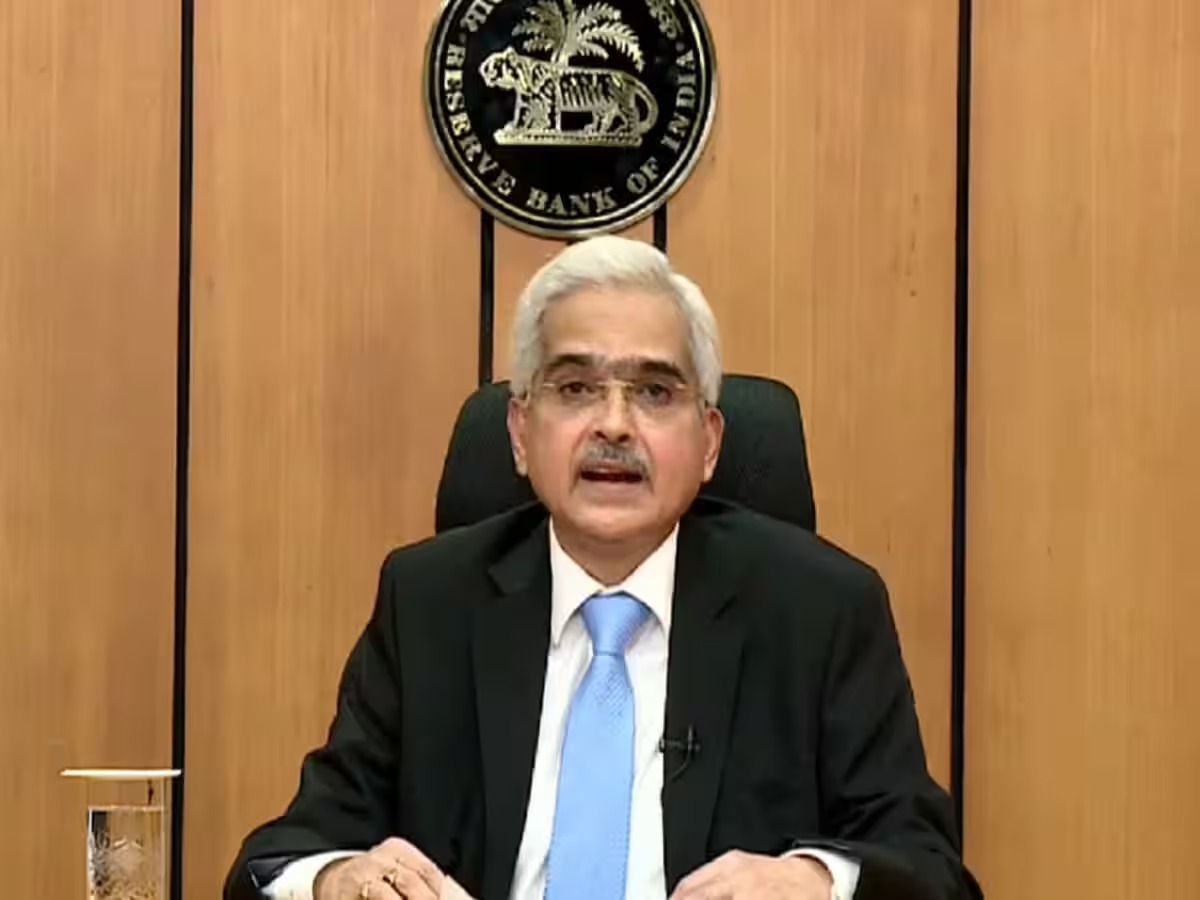

The Reserve Bank of India on Thursday announced no change in the benchmark interest rate for the ninth consecutive time. This means that the hope of cheap loans and low EMIs is shattered and we will have to wait. Reserve Bank Governor Shaktikanta Das said that the repo rate will remain at 6.5 percent. The RBI MPC voted by a 4-2 majority to maintain the policy rates. Which was in line with the expectations of most experts. This is the ninth time (in 18 months) that the six-member panel of the central bank has not changed the rates.

The central bank last raised the repo rate to 6.5 per cent in February 2023. The same rate has remained unchanged since then. Announcing the third bi-monthly monitoring policy for the current financial year, RBI Governor Shaktikanta Das said the MPC would monitor the rise in food inflation rates. The RBI has kept the growth forecast for the current financial year unchanged at 7.2 per cent.

Shock for those waiting for cheap loans

This decision of RBI is also a setback for those waiting for cheap home loans, personal loans or car loans. Given the inflation concerns and strong pace of economic growth, there was little hope of change in interest rates this time. Goldman Sachs had already expressed the possibility of keeping the repo rate at the old level. Inflation figures are running at 5 percent. If the inflation rate comes down, it will be easier for the central bank to reduce the repo rate.

Possibility of cuts in December

Shreya Sodhani, regional economist at Barclays, said that we stand by our forecast of a repo rate cut at the MPC meeting in December. However, if inflation does not remain in line with RBI's expectations, it may be delayed. Pradeep Aggarwal, founder and chairman of Signature Global (India) Ltd, said that RBI may decide to keep interest rates stable for the ninth consecutive time.

Meetings are held 6 times a year

The central bank meets 6 times every year on monetary policy. This was the second MPC meeting of the financial year 2024-25. In this meeting, the Reserve Bank reviews the repo rate keeping in mind the inflation rate. RBI takes into account many factors like demand, supply, inflation and credit before taking any decision.

What effect does this have on you?

Increasing or decreasing the repo rate by RBI affects the interest rate on loans from banks. After the repo rate increases, all types of loans including home loans, auto loans and personal loans from banks become expensive. In simple words, the bank's interest rate is high but if RBI cuts the repo rate, then the interest rate of the loan decreases.

What is repo rate?

The rate at which RBI gives loans to banks is called repo rate. Increasing the repo rate means that banks will now get loans from RBI at a higher rate. Due to which the interest rates of home loans, car loans and personal loans etc. will increase. Which will have a direct impact on your EMI.

look news india

look news india