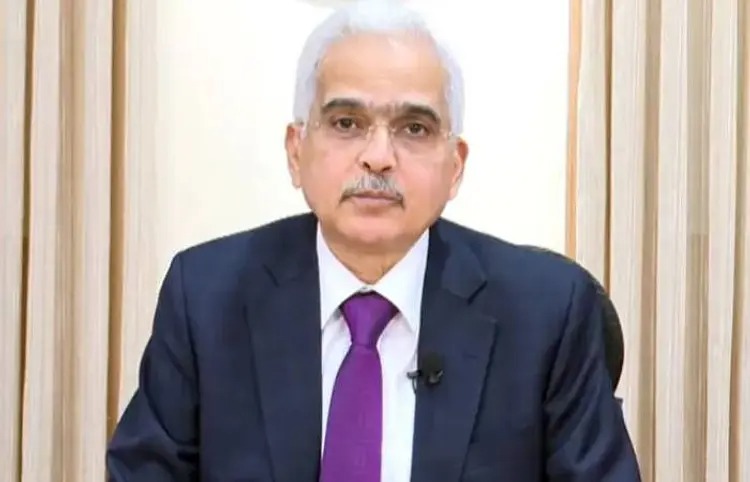

RBI to launch ULI for instant loans: The Unified Payment Interface (UPI) facility of the Reserve Bank of India has become popular all over the world. After this success, RBI is now preparing to bring Unified Lending Interface i.e. ULI in the country to bring revolution in the loan sector. With the help of which loans will be available quickly and easily. RBI Governor Shaktikanta Das gave this information while addressing a program on Monday.

Like UPI, ULI will also bring revolution

RBI launched a pilot project of ULI last year with the aim of making work in the loan sector easier and more accessible, which is expected to be launched soon. With the help of which people in small and rural areas will be able to get loans easily and quickly. This feature can bring a revolution in the digital loan sector just like UPI.

Farmers and MSMEs will benefit

Giving more information on this, RBI Governor Shaktikanta Das said that the testing of this platform was started last year to advance the revolution of digitization of banking services. Due to which the loan process has now become easy without any hindrance. On launch, especially farmers and MSMEs will be able to get loans quickly. The special thing about this platform is that it will have other data including loan records of different states, which will save time in loan approval for borrowers from small and rural areas.

Now no documents will be required for the loan

RBI Governor Shaktikanta Das said that Unified Lending Interface is part of the digitization of banking services. ULI provides digital data, including borrower records from all data providers. With the help of which the time taken in credit valuation will be reduced.

ULI Facility

ULI collects information from various sources, so the loan applicant will not need to submit too many documents. And the loan can be obtained easily. Time will be saved as the customers' Aadhaar, e-KYC as well as landing records, PAN and account related information are collected from various sources on the ULI platform.

look news india

look news india