New Delhi, August 24 (HS). Foreign institutional investors (FIIs) are seen playing the role of continuous sellers in the domestic stock market during the month of August. Domestic institutional investors (DIIs) have played the role of net buyers this month, due to which the stock market has been successful in avoiding any major decline.

According to the stock market data, foreign institutional investors have sold shares worth Rs 25,252 crore net in the stock market in the month of August so far, including all purchases and sales. Domestic institutional investors have bought shares worth Rs 47,080 crore net in the stock market in the month of August so far, including all purchases and sales.

It is clear from these figures that while foreign institutional investors are busy withdrawing their money from the domestic stock market, domestic resource investors are seen buying from all sides to prevent any fall in the market due to selling pressure. DII has bought almost twice as much as FII has sold till August 23. Due to this, despite the ups and downs in August, the movement of the stock market has not been affected much.

If we look at the total business done by foreign institutional investors and domestic institutional investors in the year 2024, then the emphasis on buying is more visible. Due to the uncertainty of the global market, foreign institutional investors have also been buying more than selling in the Indian stock market this year. If we look at the figures of purchase and sale, then this year foreign institutional investors have so far made purchases worth Rs 1,27,205 crore. Like foreign institutional investors, domestic institutional investors have also given more emphasis on buying than selling this year. This year, DII has made purchases worth Rs 3,12,127 lakh crore in total purchase and sale.

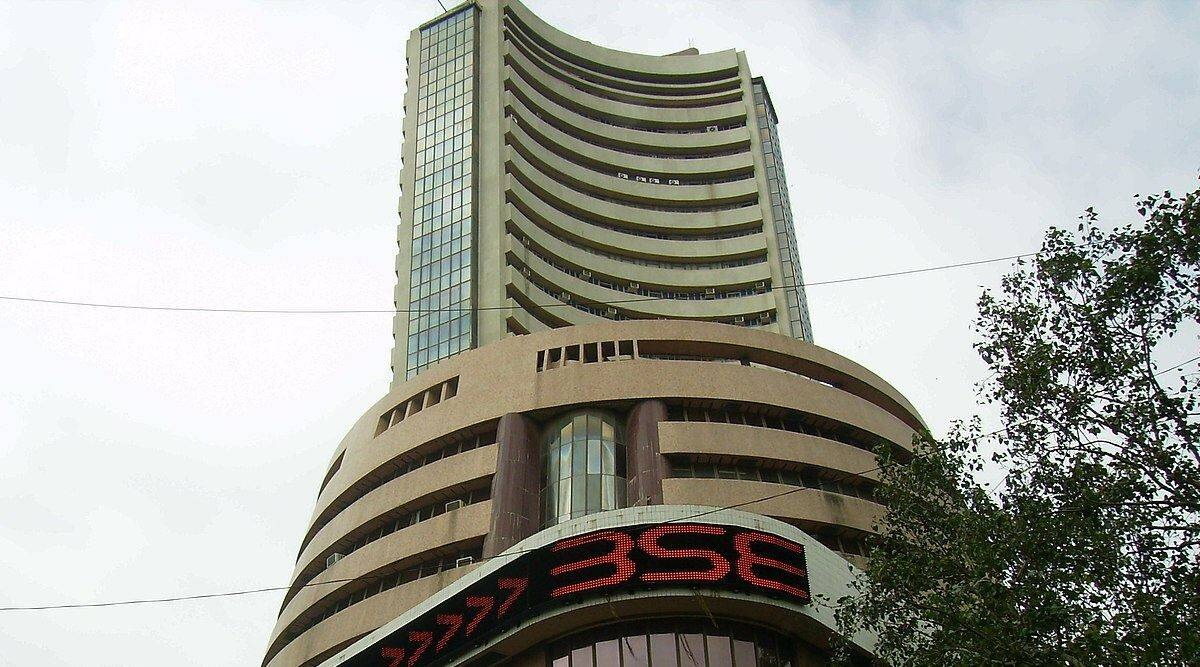

Due to the continuous buying by FIIs and DIIs in the stock market, the Sensex has jumped more than 9,900 points so far this year. However, due to profit booking by foreign institutional investors in the month of August, the clear gain of the Sensex has come down to 8,867 points. On January 1, the Sensex opened at a level of 72,218.39 points. Due to the all-round buying by FIIs and DIIs this year, on August 1, this index strengthened by more than 9,900 points and reached the highest level of 82,129.49 points. After this, due to profit booking by foreign institutional investors, on August 23, the Sensex fell from the upper level and closed at the level of 81,086.21 points.

Like the Sensex, the Nifty opened at 21,727.75 points on January 1 this year. On August 1, the index managed to gain more than 3,350 points and reach its highest level of 25,078.30 points. However, due to profit booking, the index also fell after August 1 and reached 24,823.15 points on August 23. Due to this fall, the Nifty has registered a gain of 3,095 points so far this year.

According to stock market expert Vinod Chauhan, the position of domestic institutional investors in the Indian stock market has become very strong during the last 5 years. Earlier, the domestic stock market usually fell due to the selling done by foreign institutional investors, but now the situation has changed. Domestic institutional investors have now adopted the method of aggressive buying in response to the selling by foreign institutional investors, due to which the movement of the domestic stock market is not affected much. Due to this, the interests of small and retail investors are also usually protected.

look news india

look news india