Income Tax Refund: According to the Income Tax Department, about 7.28 crore Income Tax Returns (ITR) have been filed this year till July 31, 2024. Out of these, about 5 crore ITRs were filed till July 26. The remaining 2.28 crore ITRs were filed between July 27 and 31. In such a situation, according to the rules, the deadline for ITR filed between July 26 and July 31 is also falling between August 26 and 30. In such a situation, if you have also filed ITR on these dates, then now you have only 10 days left for its verification. In such a situation, you should not delay now to avoid penalty.

30 days time to submit e-verification or ITR-5

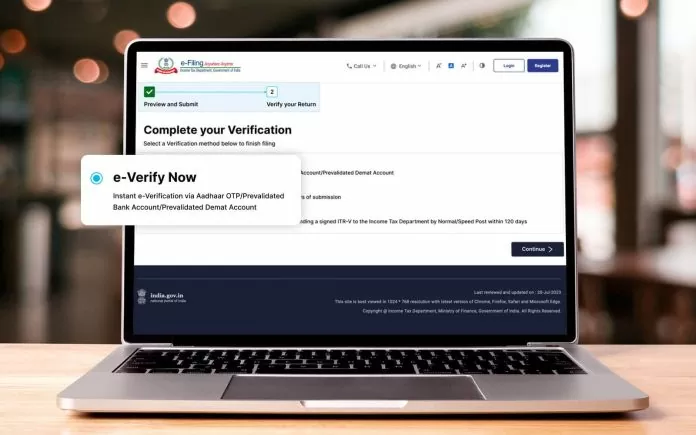

According to the Income Tax rules, after filing the ITR, you get 30 days to do e-verification or submit ITR-5 offline. According to the information received from the IT department, a total of 7,41,37,596 ITRs have been filed till August 20. Also, 7,09,89,014 ITRs have also been verified. In such a situation, about 32 lakh people have still not verified their ITR. Apart from this, out of those who have filed ITR till July 31, about 19 lakh have not yet verified their ITR.

If you want refund, get verification done within 30 days of filing ITR

In such a situation, you have to keep in mind that there should not be a gap of more than 30 days between filing ITR and e-verification. Your refund will come only when you verify the ITR. For example, if you have filed your ITR on 31 July, then the last date to verify it will also be 30 August. According to the report of Economic Times, if you miss this deadline, it will also be considered late filing. In such a situation, you may have to pay a fine.

Not only will you lose your refund but you may also have to pay a fine of up to Rs 5000

According to the rules, if you do not do the verification within 30 days, then you will not get a refund under any circumstances. In such a situation, you may have to suffer huge losses due to a small mistake. Also, your ITR will also be canceled. You will have to file ITR again and will also have to pay a penalty for filing late. Due to this mistake, you may suffer a loss of Rs 1000 to Rs 5000.

look news india

look news india