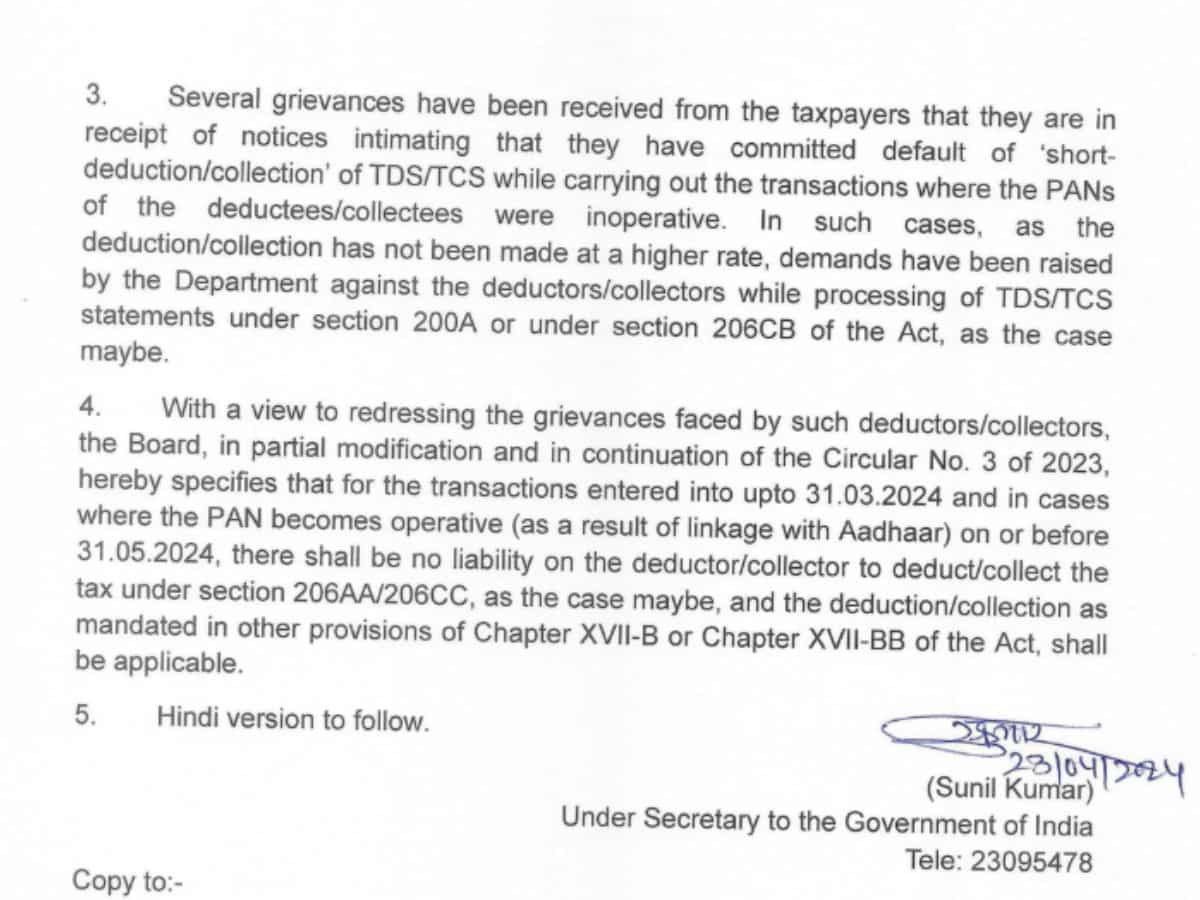

Income Tax Circular: There is great news for taxpayers. The government has given a big relief to taxpayers/businessmen regarding TDS/TCS deduction. Exemption has been given for deactivating PAN (Permanent Account Number). A circular has been issued in this regard by the Revenue Department of the Finance Ministry on Tuesday. Actually, taxpayers have been exempted from the rule of double deduction on deactivation of PAN. Now there will be no double deduction on deactivated PAN.

When will you receive benefits?

A provision has been made to deduct double tax in case the PAN is deactivated, the exemption on which will continue till 31 May 2024. The rule of no double deduction will remain in force till 31 May. In this, transactions done till 31 March will also be exempted from this rule.

Note: What is TDS?

TDS is deducted on different income sources. Such as salary, interest or commission on any investment etc. The government collects tax through TDS. However, it does not apply to every income and transaction.

Some rules have been set by the Income Tax Department for deducting TDS. Let us tell you that the government does not deduct TDS directly.

The responsibility of depositing TDS in the government account lies with the person making the payment or the paying institution. Those who deduct TDS are called deductors. The person who receives the payment after deducting the tax is called the deductee.

The rates of TDS start from one percent and go up to 30 percent. If we talk about TDS on salary only, then 10 percent TDS is levied on the total income of a person according to the income slab. At the same time,

On maturity of FD, 10% TDS has to be paid. If the customer has not given his PAN card details to the bank, then 20% TDS is charged.

What is TCS: TCS is actually called tax deposited at source. It is also called tax collected from income. TCS is paid by the seller, dealer, vendor and shopkeeper. TCS is actually deducted on high value transactions.

look news india

look news india