Mumbai/New Delhi, 06 December (Hindustan Reporter). The Reserve Bank of India (RBI) has reduced the cash reserve ratio (CRR) by 0.50 per cent to four per cent to ease the possible liquidity crisis. This will provide additional cash of Rs 1.16 lakh crore to banks.

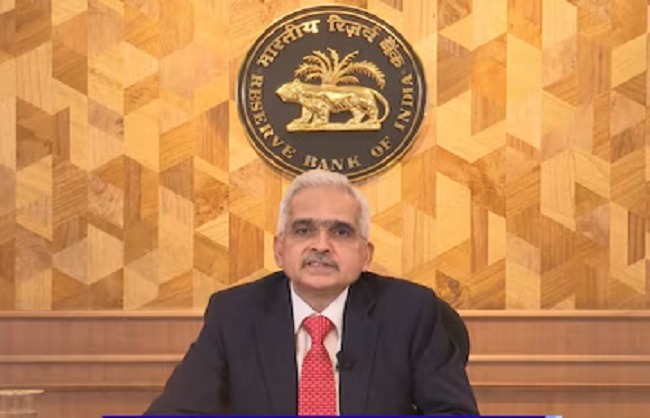

While giving information about the decision taken in the review meeting of the Monetary Policy Committee (MPC) here on Friday, Reserve Bank Governor Shaktikanta Das said that the Permanent Deposit Facility (SDF) rate will be 6.25 percent and the Marginal Standing Facility (MSF) rate and bank rate will be 6.75 percent. But it will remain. Shaktikanta Das said that despite the significant increase in currency circulation and capital outflows during festivals, there is sufficient liquidity in the banking system, but tax payments, increase in currency in circulation and volatility in capital flows will lead to losses in banks in the coming months. Cash may be less.

RBI Governor said that keeping in mind the possible liquidity crisis, it has been decided to reduce the CRR of all banks to four percent of Net Demand and Time Liabilities (NDTL) i.e. the amount of money available with the banks for lending, which is 0.25. Two equal installments of 100 per cent will be effective from the fortnight starting December 14 and December 28 respectively.

look news india

look news india