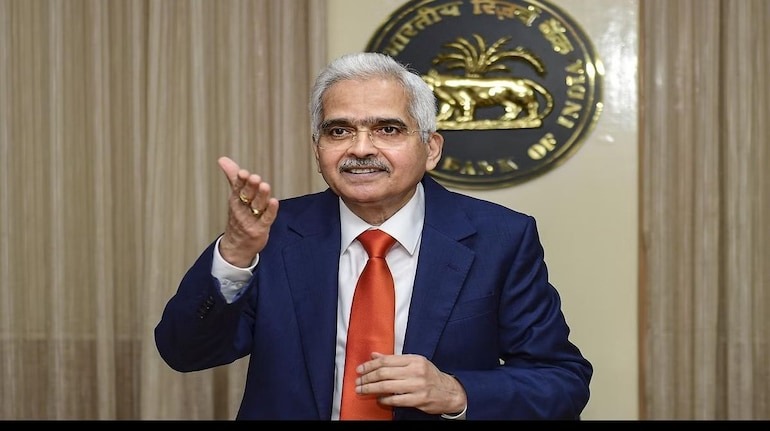

RBI Monetary Policy: RBI has presented its monetary policy for December. RBI Governor Shakikant Das presented the results of the MPC meeting on December 6 at 10 am. He said that the MPC has decided not to make any changes in the repo rate. It will remain at 6.5 percent. This was already expected. It was believed that in view of the increase in inflation, RBI will not cut the interest rate in the December monetary policy.

The MPC meeting started on 04 December. RBI Governor Shaktikanta Das announced the results after the end of the meeting on December 06. He said that price stability is most important. Development is also very important. GDP growth has not been ignored. The job of MPC is to take care of both. Central banks around the world have been challenged to keep prices under control while boosting growth. This challenge is facing both developed and developing countries.

He said that keeping in mind the macroeconomic conditions, the MPC has decided to keep the repo rate stable at the ratio of 4-2. It will remain at 6.5 percent. This means that at present there is no change in the home loan EMI. However, it was already anticipated that RBI would not reduce the interest rate in the December policy, but this has disappointed home loan borrowers.

Experts say that due to increase in inflation in October, the Reserve Bank has decided not to cut interest rates. 4 out of 6 MPC members believed that now is not the right time to change the repo rate, while 2 members believed that the repo rate should be reduced. But, when more members voted for the proposal to reduce the repo rate, RBI decided not to reduce the repo rate.

look news india

look news india