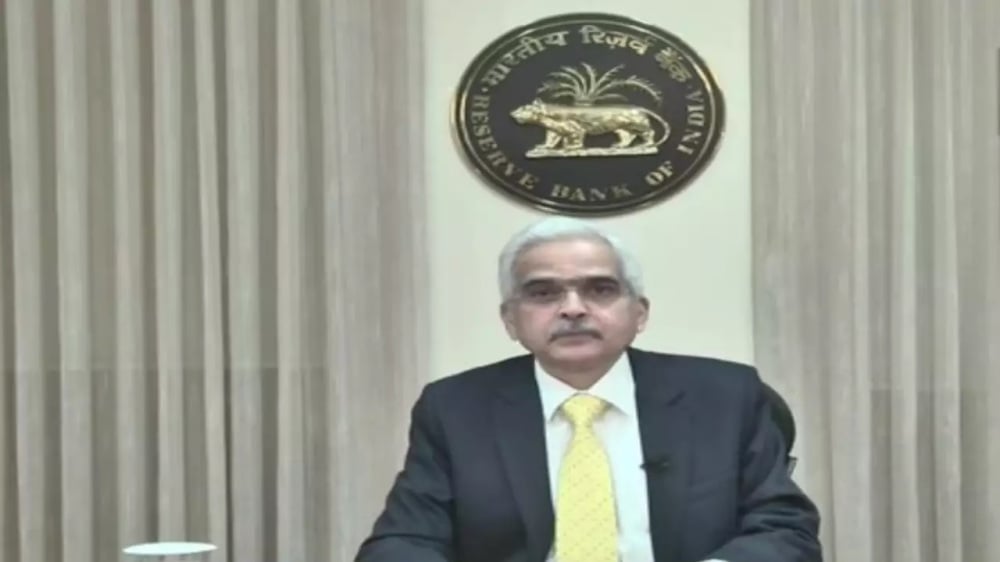

Reserve Bank of India Governor Shakti Kant Das has taken a big decision regarding the repo rate. This time also no change has been made in the repo rate. The repo rate is still stable at 6.50 percent. This is the 11th time that no change has been made in the repo rate. The Reserve Bank last revised the interest rate in February 2023 and increased it by 25 basis points to 6.50 percent. No changes have been made since then.

Focus on bringing inflation to target – Shaktikanta Das

Announcing the last monetary policy of his tenure, Reserve Bank of India Governor Shaktikanta Das said that the majority of members have decided that the repo rate should be kept unchanged. The MPC has decided that the focus will be on bringing inflation back to target. That’s why the repo rate is not being cut right now.

Governor Shaktikanta Das further said that the central bank has maintained the policy repo rate at 6.5 percent. He said the central bank has maintained its neutral stance with a 4:2 majority. According to Das, the stable repo rate indicates a cautious approach towards the current economic situation. Das said during his speech that monetary policy has broader implications, but price stability is important for every section of the society.

GDP estimated to be 6.6 percent

The country’s development may be harmed in this war of inflation. This is indicated by RBI estimates. RBI MPC has reduced the GDP growth estimate for the current financial year to 6.6 percent. Which was earlier 7 percent. This is the second consecutive time that RBI has cut its GDP estimates. In the October meeting, the RBI MPC reduced the GDP estimate from 7.2 percent to 7 percent.

Effect of repo rate on EMI

Importantly, the MPC of the RBI meets every two months and six members including Reserve Bank Governor Shaktikanta Das discuss inflation and other issues and changes (changes in rules). Let us tell you that repo rate is directly related to the customers taking loan from the bank. Its decrease reduces the EMI of the loan and its increase increases the EMI. Repo rate is the rate at which the central bank of a country lends money to commercial banks in case of shortage of funds. Repo rate is used by the monetary authority to control inflation.

look news india

look news india