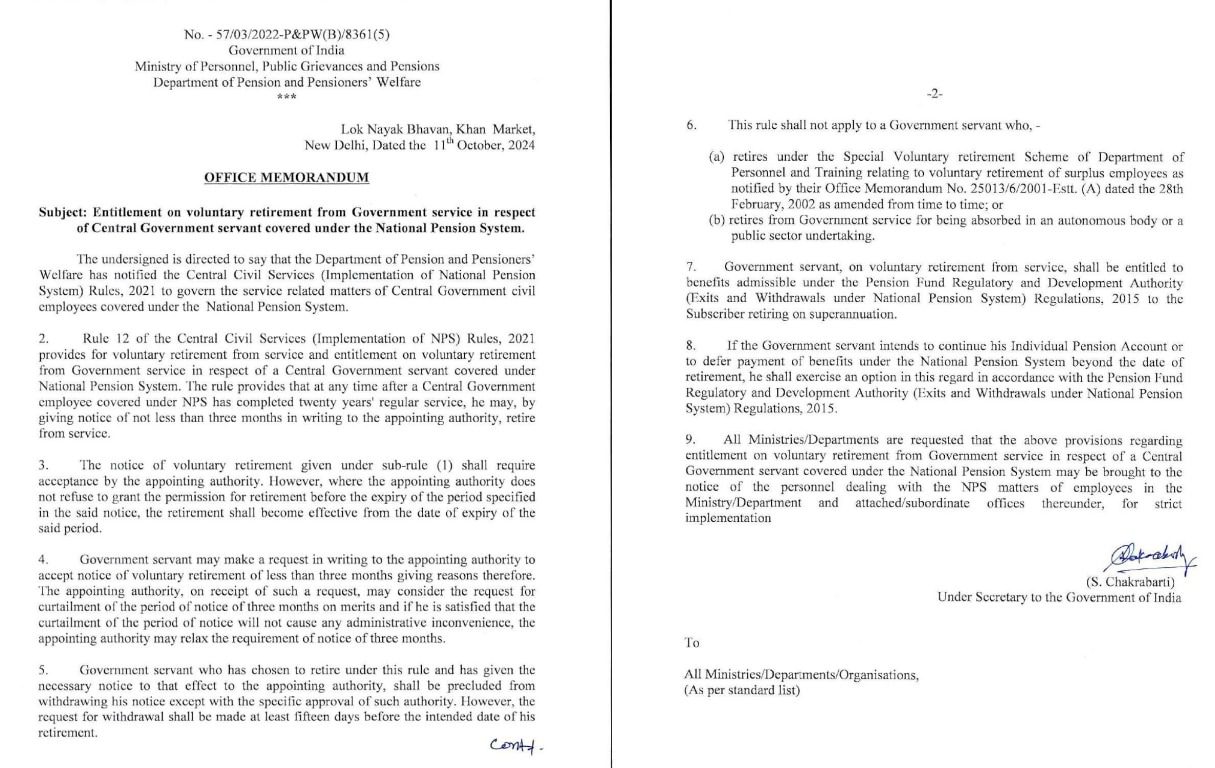

National Pension System: The government has issued new guidelines regarding voluntary retirement of central employees covered under NPS. According to this new guideline of the Pension and Pensioners' Welfare Department, central employees who have completed 20 years of regular service can, if they wish, seek permission for voluntary retirement by giving three months' notice to the appointing authority.

The Department of Pension and Pensioners' Welfare has issued an office memorandum dated 11 October 2024. According to these new rules, employees who have completed 20 years of service can apply for voluntary retirement after that if they wish. For this they will have to apply to the authority that has appointed them. If the authority does not reject the request of the central employee then retirement will become effective as soon as the notice period expires.

According to this rule, if a central government employee wants to retire with a notice period of less than three months, he will have to request for it in writing. The appointing authority may shorten the notice period after considering the request. Once a Central Government employee gives notice for voluntary retirement, he cannot withdraw it without the approval of the authority. To withdraw it, the application has to be made 15 days before the date of seeking retirement permission.

According to the office memorandum of the Department of Pension & Pensioners' Welfare (DoP&PW), government employees who are taking voluntary retirement will be given all the benefits under the PFRDA Regulations 2015. He will get all the facilities at the standard retirement age that are given to a regular government employee on retirement. If a government employee wishes to continue the Individual Pension Account or defer the benefits under the National Pension System on the date of retirement, he can exercise this option under the PFRDA Regulation.

According to the Department of Pension and Pensioners' Welfare, if an employee retires under the Special Voluntary Retirement Scheme due to being a surplus employee, then this rule will not be applicable to such employees. Also, if an employee is placed in a public sector undertaking or autonomous body after retirement from a government job, then this rule will not apply to them also.

look news india

look news india