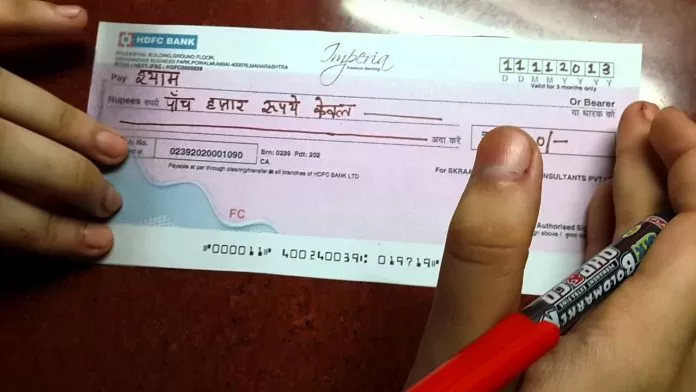

In today's time, of course, most people resort to digital payment, but still there are many such tasks for which checks are still required. but check While making payment, it should be filled very carefully because your small mistake can cause the check to bounce. In the language of banks, check bounce is called dishonored cheque. Bouncing a check may seem like a trivial matter to you, but according to Section 138 of the Negotiable Instruments Act 1881, bouncing a check is considered a punishable offence. There is a provision for punishment or fine or both for this.

Know the reasons why a check may bounce

There can be many reasons for check bounce. These include no or low balance in the account, signature not matching, mistake in writing words, mistake in account number, overwriting, expiry of cheque, closure of account of the person issuing the cheque, suspicion of fake cheque, company on cheque. This includes absence of seal etc.

Can the mistake be corrected?

Yes, if your check bounces you are given full opportunity to rectify the mistake. It does not happen that your check bounces and you get sued. If your check

If your second check also bounces, the bank first informs you about it. After this, you have 3 months to give another check to the creditor. If your second check also bounces, the creditor may take legal action against you.

Banks impose fine if check bounces

Banks impose penalty if check bounces. The fine has to be paid by the person issuing the cheque. This penalty may vary according to the reasons. Every bank has fixed a different amount for this.

When does the case arise?

This is not so, as soon as the check bounces, a case is registered against the payer. When a check bounces, the bank first gives a receipt to the creditor, in which the reason for the check bounce is explained. After this the creditor can send a notice to the debtor within 30 days. If no response is received from the debtor within 15 days of the notice, the creditor can go to court. The creditor can file a complaint in the Magistrate Court within one month. Even after this, if he does not get the money from the debtor, he can file a case against him. If found guilty, a jail term of up to 2 years or a fine or both can be imposed.

look news india

look news india