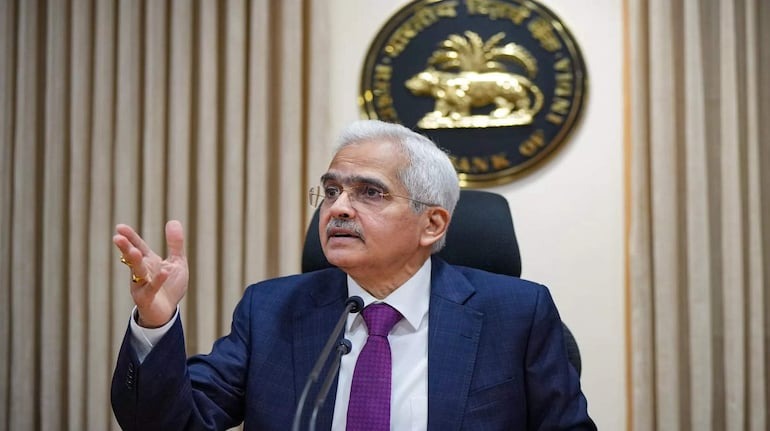

reserve Bank of India (RBI) Governor Shaktikanta Das has banned non-banking financial companies. (NBFC) They have been warned not to adopt wrong methods to promote their business. Strict action may be taken against any NBFC found guilty of doing so. Announcing the decisions of the bi-monthly monetary policy review meeting, the Governor strictly asked such NBFCs to follow honest, fair and sustainable practices.

Consider customer complaints honestly

Das clearly said that NBFCs including MFIs (Micro Finance Institutions) and HFCs (Housing Finance Companies) should follow sustainable business goals. It also calls for adopting a compliance-first culture, adopting a robust risk management framework, strictly adhering to the Fair Practices Code and treating customer complaints honestly. He warned that the Reserve Bank is keeping a close watch on these areas and will not hesitate to take appropriate action if necessary.

NBFC should reform itself

Governor Shaktikanta Das said that the Reserve Bank of India wants NBFCs to improve themselves. He said that the NBFC sector has registered impressive growth over the last few years and such lenders have helped in the policy objective of financial inclusion. However, he regretted that some NBFCs are growing aggressively without building sustainable business practices and risk management framework. The Governor said that an indiscriminate approach to development at any cost would be counterproductive for them.

Also asked to review

Das also asked organizations to review remuneration practices, variable pay and incentive structures for their employees, as he believes some of these appear to be entirely target-based. This can result in an unfavorable work culture and poor customer service. Das asked banks and NBFCs to carefully assess the size and quality of their personal loans in these sectors and closely monitor credit.

look news india

look news india