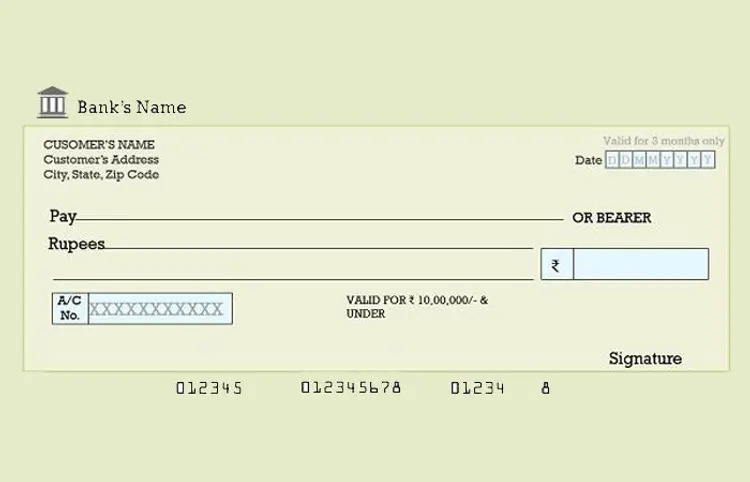

Bearer Cheque Details: Cheques are still as important in the digital age. Even today people are preferring cheques for large transactions and corporate transactions. But it is very important to know the rules related to transactions through cheques. A small mistake can turn into a big loss.

Errors or defects in the cheque can also lead to cheque bounce and misuse. We are telling you about the rules related to cheques. So that no mistake is made while giving cheques in future.

Do not make this mistake in bearer cheque

Cheques are a powerful financial resource. Which makes the transaction of money easy. But before signing any cheque, it is important to know who you are giving the cheque to. And it is also important to know its purpose.

Sign the back of the bearer cheque

Not all types of cheques require signatures while issuing them. But there are some cheques which require signatures on the back. Bearer cheques must have signatures on the back. If you have an order cheque, you do not need to sign on the back. A bearer cheque is a cheque that any person can deposit in the bank and receive money. It does not have the name of any person. Therefore, it is necessary to sign on the back.

do this for accuracy

If you are issuing a bearer cheque, the person issuing it must sign the back of the cheque. Failure to do so increases the risk of accidental loss or theft. In such a case, huge losses can occur. Since this type of cheque does not have the name of the person, anyone can use it. That is why the bank asks to sign the back of the cheque. Signing the back of the cheque ensures a secure transaction. And it shows your consent.

look news india

look news india