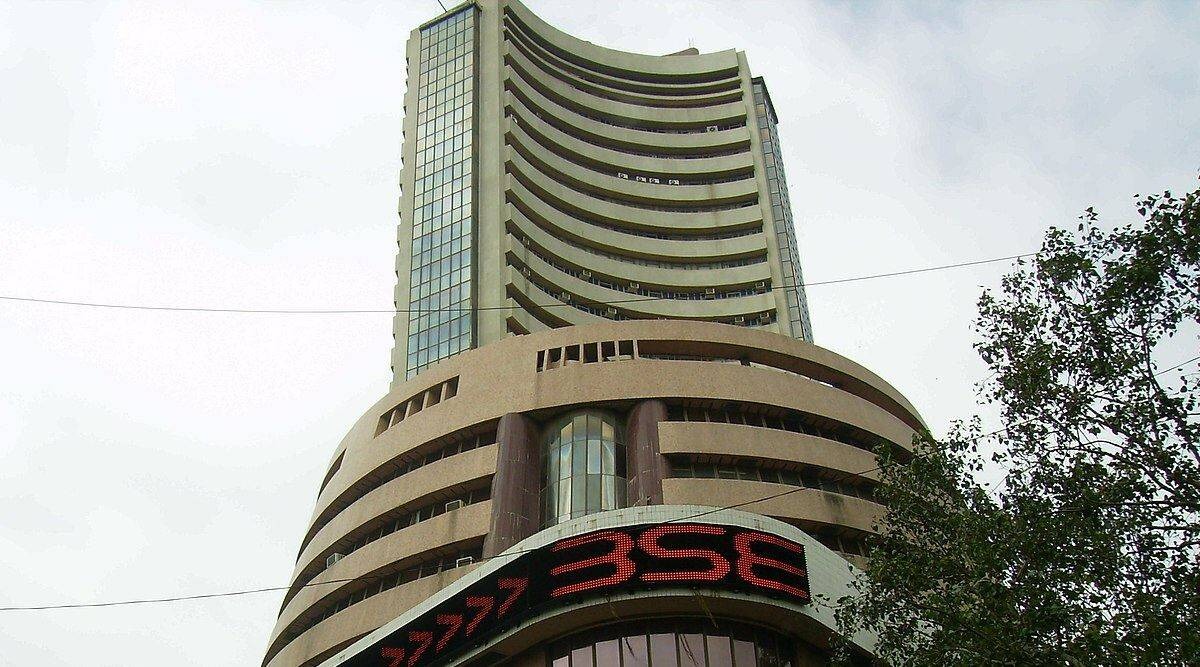

New Delhi, September 19 (HS). The impact of the US Federal Reserve's decision to cut interest rates was also seen on the domestic stock market today. The Indian stock market started trading today by setting a new record of all-time high. In the first hour of trading, Sensex and Nifty managed to reach a new peak of strength with the support of buying, but later due to profit booking, Sensex and Nifty fell from the upper level. After the whole day's trading, Sensex closed with a gain of 0.29 percent and Nifty closed with a gain of 0.15 percent.

There was a massive sell-off in the telecom sector during the day's trading today, due to which the telecom index fell by more than 3 percent. Apart from this, selling pressure was also seen in IT, Capital Goods, Tech, Pharmaceutical, Public Sector Enterprise, Oil & Gas and Metal Index. On the other hand, buying continued in the shares of automobile, FMCG, consumer durables and banking sector. In the broader market too, there was continuous selling pressure in small and medium stocks today, due to which the BSE midcap index closed with a decline of 0.53 percent. Similarly, the smallcap index ended today's trading with a decline of 1.06 percent.

Despite the strength in the stock market today, the wealth of stock market investors decreased by more than Rs 2 lakh crore due to the sell-off in midcap and small cap stocks. The market capitalization of companies listed on BSE decreased to Rs 465.68 lakh crore (provisional) after today's trading. Whereas on the previous trading day i.e. Wednesday, their market capitalization was Rs 467.72 lakh crore. In this way, investors suffered a loss of about Rs 2.04 lakh crore from today's trading.

There was active trading in 4,075 shares on the BSE during today's trading. Of these, 1,246 shares closed with a gain while 2,734 shares showed a decline, whereas 95 shares closed without any fluctuation. There was active trading in 2,470 shares on the NSE today. Of these, 678 shares closed in the green zone after making profits, while 1,792 shares closed in the red zone after incurring losses. Similarly, out of the 30 shares included in the Sensex, 19 shares closed with a gain and 11 shares closed with a decline. While, out of the 50 shares included in the Nifty, 27 shares closed in the green zone and 23 shares closed in the red zone.

The BSE Sensex today jumped 410.94 points and opened at a new all-time high of 83,359.17 points. As soon as the trading started, with the support of buying, the index gained 825.38 points and reached its highest level of 83,773.61 points. However, this rise in the Sensex could not last long, because after reaching this height, profit booking started in the market, due to which the movement of this index also declined. After the whole day's trading, the Sensex closed at a level of 83,184.80 points with a gain of 236.57 points.

Like the Sensex, NSE's Nifty also started trading at 25,487.05 points today, setting a new all-time high with a gain of 109.50 points. After the market opened, with the support of buying, the index gained 234.40 points and reached its highest peak of 25,611.95 points, but after that, the index's movement declined as profit booking started. Due to continuous selling, the index fell more than 235 points from the upper level and reached 25,376.05 points in the red zone for some time with a weakness of 1.50 points. However, due to minor buying at the last moment, the index recovered from the lower level and closed at 25,415.80 points with a gain of 38.25 points.

After the day's buying and selling, among the big stocks of the stock market, NTPC 2.37 percent, Kotak Mahindra 1.75 percent, Titan Company 1.49 percent, Nestle 1.43 percent and Hindustan Unilever 1.25 percent were included in the list of today's top 5 gainers. On the other hand, BPCL 3.47 percent, Coal India 1.88 percent, ONGC 1.77 percent, Adani Ports 1.44 percent and Shriram Finance 1.38 percent were included in the list of today's top 5 losers.

look news india

look news india