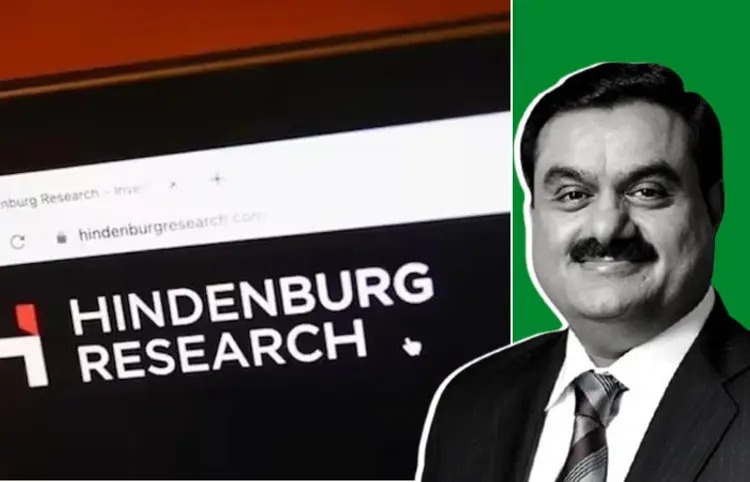

Hindenburg vs Adani Group : US short seller firm Hindenburg Research has made fresh allegations against the Adani Group. Hindenburg claims that Swiss authorities have frozen $310 million (about Rs 2,600 crore) in six Swiss bank accounts of the Adani Group in a money laundering and fraud case.

Hindenburg has accused Adani through a social media post and has also claimed that its investigation has been going on since 2021.

What is the allegation?

Gotham City-based Swiss media company Hindenburg has made serious allegations against Adani. It is alleged that a frontman representing Adani invested in opaque (suspicious) funds based in the British Virgin Islands/Mauritius and Bermuda. Most of them held exclusively Adani shares. Most of this investment money was invested in Adani shares. There were six such accounts in Swiss banks which have now been frozen.

What was Adani's reaction?

However, like before, this time too all the allegations of Hindenburg have been rejected by the Adani Group. A statement has been issued by Adani. Adani Group says that all these allegations are being made to reduce its market value. Adani Group has said, 'We have nothing to do with any case of the Swiss court. None of our bank accounts have been frozen. We have no hesitation in saying that these allegations are being made to damage our reputation and market value.'

look news india

look news india